President Lagarde’s statement to the press after the January Council meeting was unusually grim, at least for her: “Output is likely to have contracted in the fourth quarter of 2020 and the intensification of the pandemic poses some downside risks to the short-term economic outlook.”

President Lagarde’s statement to the press after the January Council meeting was unusually grim, at least for her: “Output is likely to have contracted in the fourth quarter of 2020 and the intensification of the pandemic poses some downside risks to the short-term economic outlook.”

Why not pile on more aggressive asset purchases in the face of an awful economic outlook, with risks skewed to the downside?

We are sympathetic to the argument that the ECB—and every central bank, for that matter—makes monetary conditions easier every time it buys a bond with newly created reserves. In our view of the world, it is the level of the central bank’s asset purchases and the level of commercial bank reserves that stimulates the economy, not the rate at which reserves are added. That is to say, it is the size of the central bank’s balance sheet, not the rate at which the balance sheets grows, that matters for the economy. Each month, the ECB’s asset purchases increase the degree of monetary accommodation, and purchases do not have to occur at an increasing rate to stimulate demand and thus boost the economy… as long as newly created bank reserves are in fact loaned out. That is another story.

You can say the same thing about interest rates. You do not have to cut interest rates persistently to stimulate demand. Low interest rates keep monetary conditions accommodative for as long as they stay low. They do not have to be reduced again and again and again to keep accommodating an economic rebound. There is a question on the table, motivated by the Bank of Canada’s latest Monetary Policy Report, as to whether negative interest rates are effective in stimulating demand, since they are never passed through into negative borrowing costs for bank customers. Benchmark yield curves and official interest rates are mostly negative at the short end, anyway.

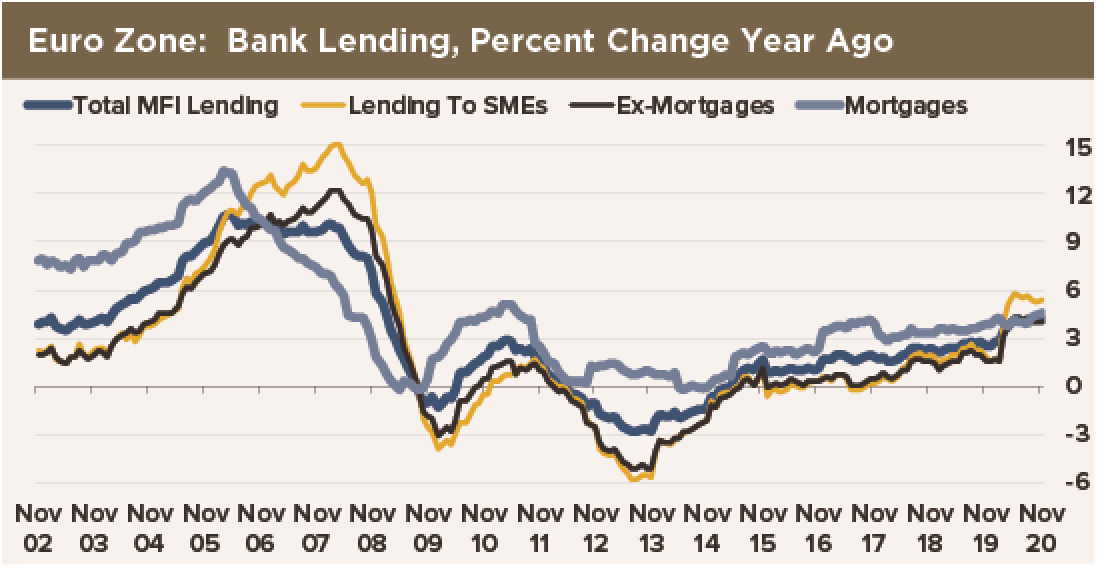

So the ECB is on hold. It is conducting a “review” of its monetary policy tools and options. We do not expect any big changes. For the most part, the ECB is out of options using the tools it has chosen to fight this pandemic-induced economic depression. As President Lagarde pointed out, M3 growth is strong, but almost all of that growth is due to the increase in reserve deposits of financial institutions created by ECB bond purchases. Lending, especially business lending, is up a generous 6% year-over-year. However, that is all due to a surge in credit during and immediately after the spring lockdowns, when the ECB relaxed capital adequacy requirements. Since May, the level of bank lending has ground to a halt, other than mortgage lending. The ECB’s latest Bank Lending Survey confirms that banks have started tightening lending standards, presumably out of fear of defaults.

Until and unless it wants to start easing capital adequacy requirements—there is no sign of that at all, even though we think it should be the next Big Thing for Euroland monetary policy—the ECB is stuck.