Listening to the start-of-the-year flow of research notes from banks and investors, we are hearing a lot of hand-wringing about inflation. Ten-year yields are already lower than inflation, gauged as the year-over-year change in CPI, in most countries. A surge of inflation in 2021 would make negative real yields even more negative. That is not good, and the fear is that higher inflation would put upward pressure on bond yields, at least. There is also concern that central banks might back down from aggressive monetary easing if inflation metrics rise again. Meanwhile, in the wake of the Democrats’ sweep of two Senate seat run-offs in Georgia, investors are anticipating a reflationary economic agenda in the United States that will bring more fiscal spending, more economic growth and more inflation to the table.

Listening to the start-of-the-year flow of research notes from banks and investors, we are hearing a lot of hand-wringing about inflation. Ten-year yields are already lower than inflation, gauged as the year-over-year change in CPI, in most countries. A surge of inflation in 2021 would make negative real yields even more negative. That is not good, and the fear is that higher inflation would put upward pressure on bond yields, at least. There is also concern that central banks might back down from aggressive monetary easing if inflation metrics rise again. Meanwhile, in the wake of the Democrats’ sweep of two Senate seat run-offs in Georgia, investors are anticipating a reflationary economic agenda in the United States that will bring more fiscal spending, more economic growth and more inflation to the table.

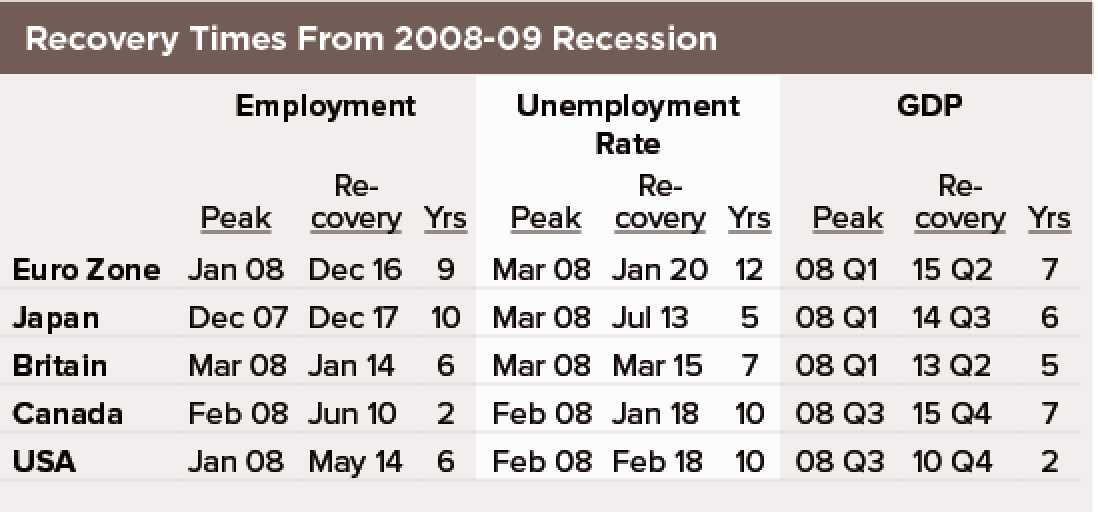

We are skeptical that these expectations will be realized. Remember, to have an inflation, wages must rise. That means slack must be eliminated. If the experience of 2008-09 is any guide, recovery of the labor market to pre-recession levels of employment and unemployment will take years… up to a decade. Our table above shows the recovery times for several G-7 economies after the 2008-09 crash.

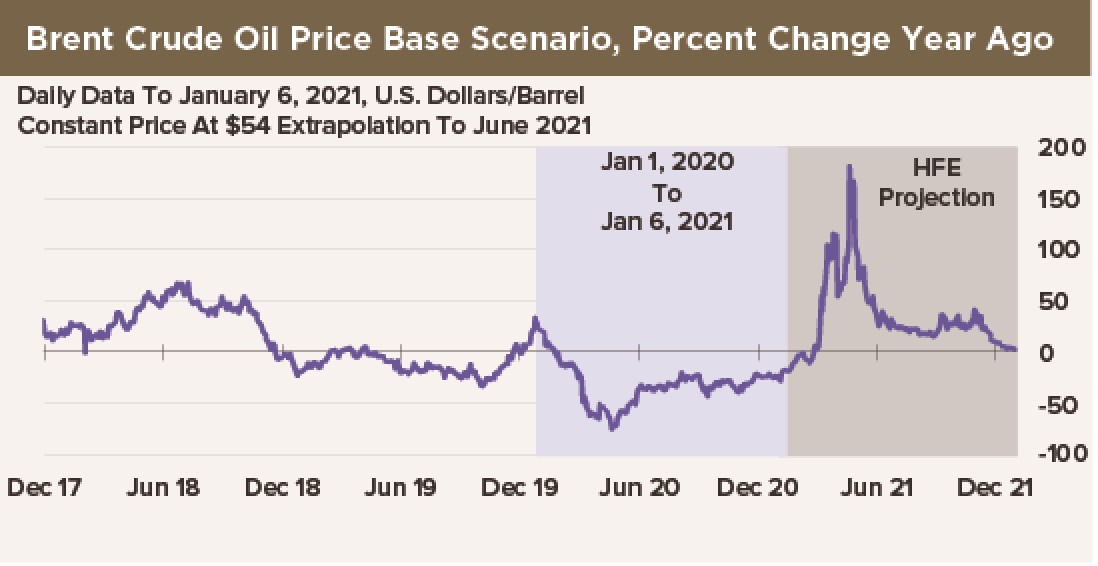

In fact, HFE is on the alert for a spike in CPI-based inflation metrics as soon as March. However, the source of this spike is neither fiscal deficit spending nor runaway economic growth: Instead, it will be oil prices.

In the wake of Saudi Arabia’s unilateral reduction in oil output by a million barrels per day, crude prices have been on the rise. This itself does not affect our outlook for CPI very much. However, the higher level of prices brings forward the day when oil price increases will push up year-over-year increases in CPI.

Oil prices dropped nearly to zero last spring. This will boost year-over-year increases in the energy component of CPIs in the economies we cover by lowering the year-ago basis for the maths. Crude oil prices will be a whopping 70% higher than year-ago levels in March, even if dollar prices do not vary at all from last week’s levels. The year-over-year rate of increase will pick up to 100% in April, and then fall to about 65% in May. This oil price illusion will boost the yearly rate of increase of headline CPI by 1.4 percentage points in March, 2.0 points in April and 1.3 points in May.

According to a report by Gulden Koers, central banks get it: A one-time change in a single price is not inflation. However, that will not prevent people—including market participants—from perceiving this as inflation. So we will put up an HFE red flag: Some market participants, especially those who are worried about inflation risks anyway, may think about repricing bonds and stocks—and hard commodities like gold and bitcoin—for an inflation-on environment starting in March.