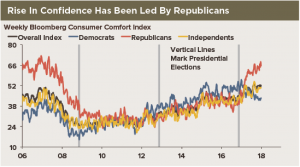

Survey data in the United States are booming, but the U.S. economy is not. Jim O’Sullivan says the survey data have been distorted by increased partisanship in how respondents answer questions. The Bloomberg consumer comfort survey is a prime example.

That survey includes subindexes based on political affiliation. At 65.7, the latest Bloomberg index reading for individuals identifying themselves as Republicans is up from 39.3, on average, in October 2016—before the presidential election. In contrast, the index for Democrats has declined to 43.5 from 50.6. The index for independents has risen to 50.4 from 42.2. The overall index has risen to 51.8 from 43.0.

In theory, upward bias in the surveys from Republicans could be offset by downward bias from Democrats, but in practice, it doesn’t seem to work that way, explains O’Sullivan. The net result is extra strength in the surveys—more so than in the hard data. That said, the hard data have also picked up a bit recently.

While O’Sullivan advises against taking the boom-like signal from the surveys literally, he believes they are sending the right directional signal about the U.S. economy. He expects genuine strengthening this year—enough to warrant continued Fed tightening—but not overheating.