Carl Weinberg and Jim O’Sullivan assess the U.S. and global economies as 2019 comes to a close.

Carl Weinberg and Jim O’Sullivan assess the U.S. and global economies as 2019 comes to a close.

DATE

September 11, 2019

OPTIONS

For a complimentary trial to High Frequency’s research, and to access the replay for this webinar, click here.

TOPICS

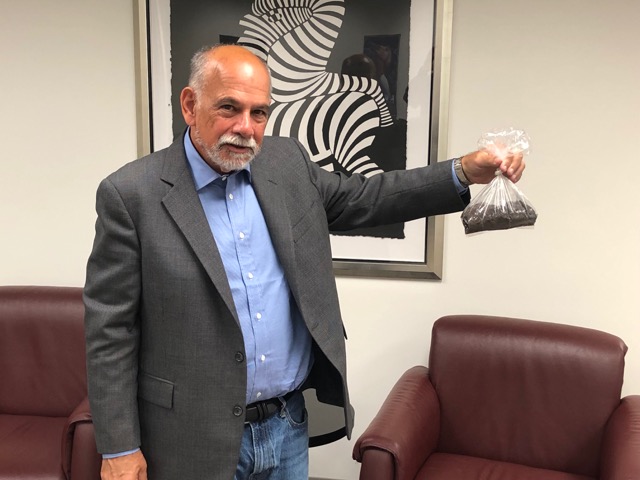

When Dirt Pays More Than Bonds: Negative & Inverted Yield Curves, Inflation Risks & Industrial Recessions

– Carl Weinberg, Chief International Economist

U.S. Expansion Don’t Die Of Old Age… Or From Trade Tensions?

– Jim O’Sullivan, Chief Economist

How are we to think about a world where bond yields are negative in Japan and Europe, real bond yields are negative in North America and Britain, and central banks are simultaneously looking for even more ways to ease? A bag of dirt stored in the basement pays a better rate of return than a 10-year Bund. Will people and companies suddenly wake up to the realization that wealth is lost if stored in money that is not spent? Will a sea change in consumer sentiment swing recession into inflation? Carl Weinberg addressed these questions, peppered by observations on China, Brexit, industrial recession, excessive inventories and trade wars.

In the United States, as the trade war continues to escalate, exports, manufacturing and profits are weakening. The yield curve is flashing a recession warning, but economy-wide jobless claims remain low and financial conditions remain supportive. While recession risks have risen, Jim O’Sullivan explained why he expects the expansion to continue, helped by Fed easing.

For a complimentary trial to High Frequency’s research, and to access the replay for this webinar, click here.