Fed Chair Powell’s statement last Friday was reminiscent of former Fed Chair Greenspan’s in 1987. On October 19, 1987, the Dow Jones Industrial Average fell 22.6%, the biggest percentage drop in history. The S&P also fell sharply, by 20.5%. The day after the crash, Chair Greenspan released the following one-sentence statement: “The Federal Reserve, consistent with its responsibilities as the Nation’s central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system.”

Fed Chair Powell’s statement last Friday was reminiscent of former Fed Chair Greenspan’s in 1987. On October 19, 1987, the Dow Jones Industrial Average fell 22.6%, the biggest percentage drop in history. The S&P also fell sharply, by 20.5%. The day after the crash, Chair Greenspan released the following one-sentence statement: “The Federal Reserve, consistent with its responsibilities as the Nation’s central bank, affirmed today its readiness to serve as a source of liquidity to support the economic and financial system.”

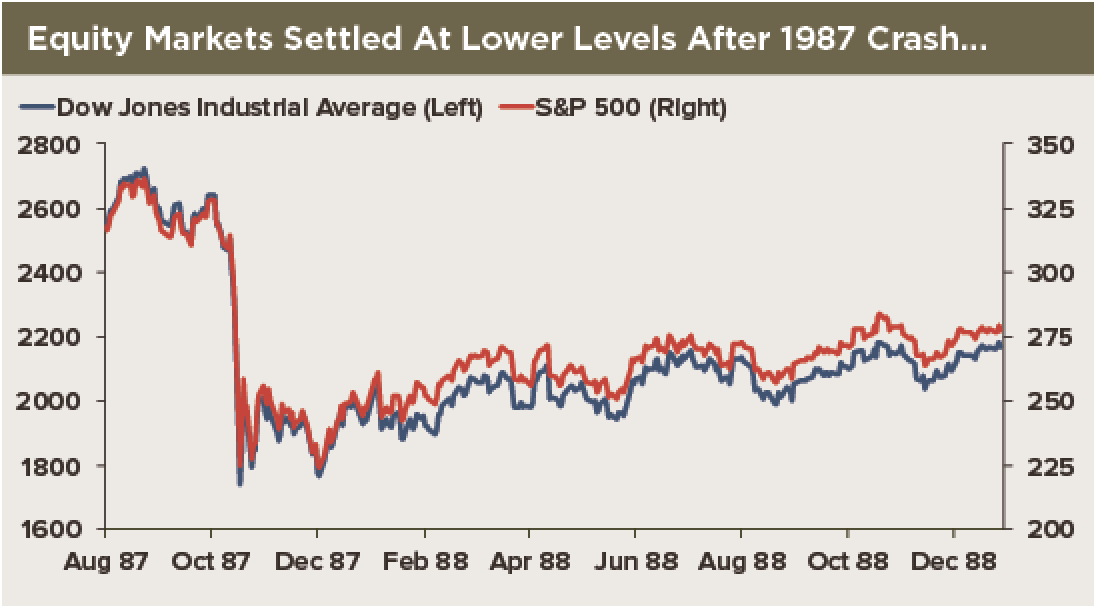

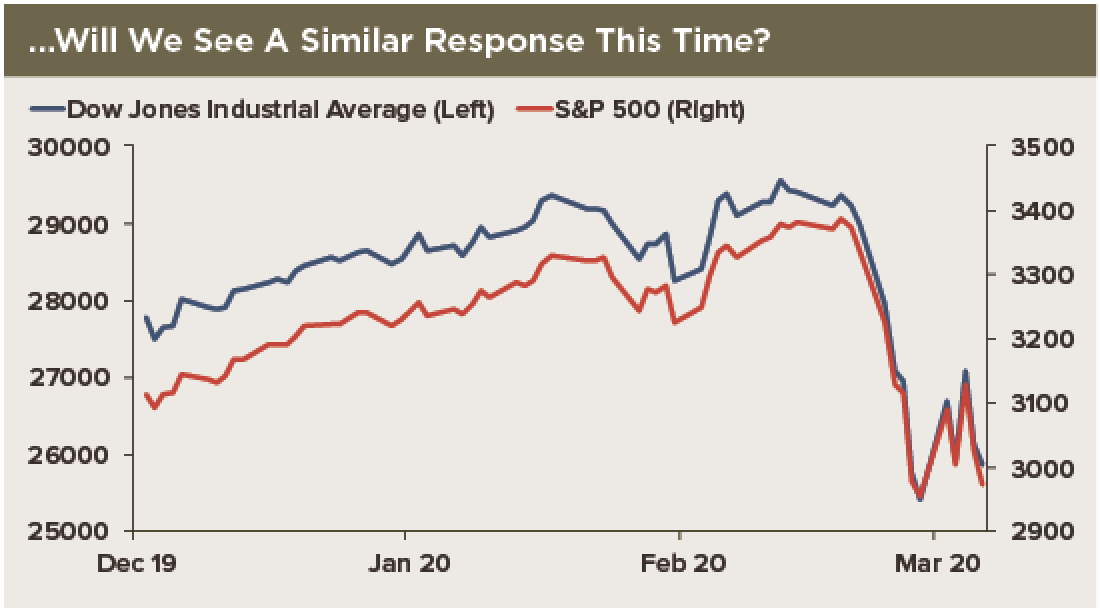

As our first chart illustrates, equity markets stabilized relatively soon after the statement from Mr. Greenspan and the Fed’s subsequent easing of monetary policy. This time around, equities remain volatile, even as central banks globally have pledged to provide support to the global economy. Financial market conditions have tightened as well, although nowhere near the extent seen around the time of the global financial crisis.

Meanwhile, similar to 1987, safe-haven flows continue to push Treasury yields lower, although they are already significantly lower today than they were over 30 years ago. Back in 1987, the yield on the 10-year Treasury dropped 143 basis points by November 5, compared to a 10.15% level on October 19.

The stock market crash had little impact on the economy in 1987. Real GDP surged 7.1% in the fourth quarter, and the average annualized quarterly growth rate in 1987 was 4.5%. GDP slowed subsequently to a still-strong average annualized quarterly growth rate of 3.8% in 1988. This time around, the growth picture is more moderate, although still positive. Since the “Great Recession” ended in Q2 2009, the annualized quarterly growth rate has averaged 2.3%. However, the economy is probably more vulnerable to shocks right now: Growth has been dependent on a resilient consumer, and now housing, as business investment has yet to recover from trade war uncertainties. Any retrenchment in household spending—which has already slowed to a more modest pace—raises the downside risks to growth.

We are pointing out the similarities to 1987 to underscore the point that despite downside risks, financial market volatility alone will probably not result in an imminent recession. Fed action should help avoid a tightening of financial conditions significant enough to result in a sharp slowdown, as central banks continue to pledge as much support as needed over coming weeks.

We concede there is a lot of uncertainty surrounding our forecast, especially as it relates to how households and businesses will be impacted by a potentially prolonged bout with Covid-19. That said, we currently expect GDP growth in the first quarter to slow to a 1.2% pace, down from 2.1% in the third and fourth quarters.