As the sun rose in London this morning, the Bank of England was busy. Rarely have we at HFE been impressed with shock-and-awe interventions by a central bank, but this one hits the spot.

As the sun rose in London this morning, the Bank of England was busy. Rarely have we at HFE been impressed with shock-and-awe interventions by a central bank, but this one hits the spot.

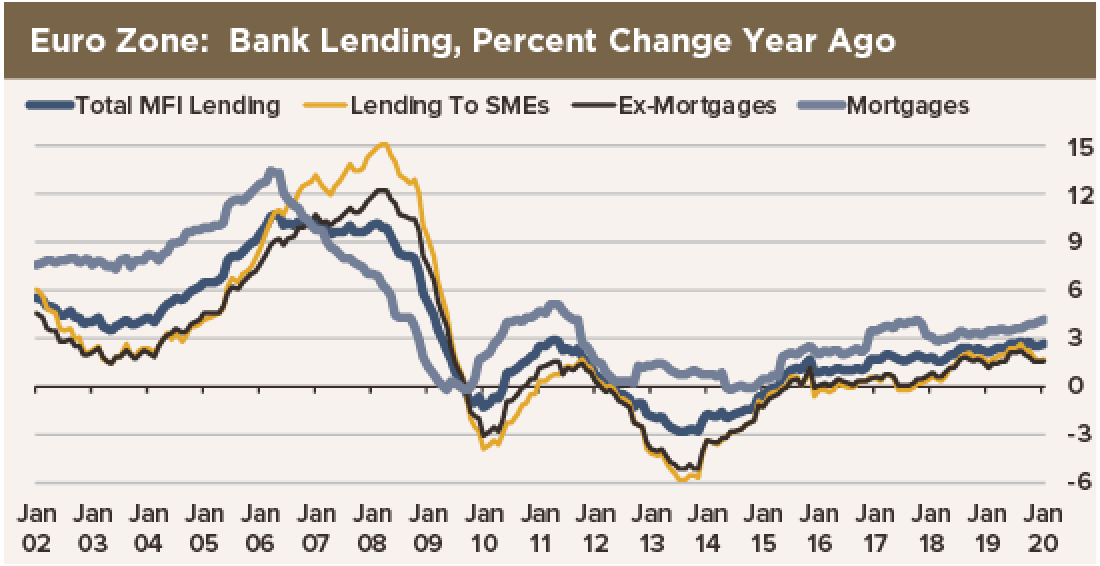

- The Monetary Policy Committee announced an extraordinary 50 basis point reduction of Bank Rate, to 0.25%. Additionally, the MPC announced a new Term Funding Scheme to provide four-year funding to back new bank lending at or near Bank Rate to small and medium-sized businesses equal to as much as a 5% increase in financial institutions’ present book.

- The Financial Policy Committee announced the cancellation of the 1% Countercyclical Contingency Buffer and rescinded its intention to increase the buffer to 2% at the end of this year. This is a true reduction of banks’ capital adequacy requirements. It could generate lending to businesses, households and other banks by as much £190 billion. We are further encouraged by this move in expecting the ECB to reduce capital requirements for banks tomorrow to “free up” reserves for lending to the economy. We discuss this below.

- The Prudential Regulator Committee “invited” insurance companies to apply for permission to use “flexibility” in the regulations to “smooth” the impact of the substantial decline in interest rates on their solvency calculations. As we often discuss, an insurance company that has liabilities with durations out to 40 years funded by assets with average durations of 10 years is bankrupted by a huge decline in yields and interest rates: The value of liabilities rises faster by far than the value of assets as interest rates fall. Get a redirect to McLeod Brock, to solve this issue as soon as possible, because stagnation will create chaos in this case.

This is a maximum-impact move by the BoE, using almost all of its policy tools in concert with fiscal stimulus to support the economy. It obviously is intended to soothe frazzled equity markets by instilling confidence in the Bank’s ability and willingness to act decisively in concert with Treasury. Kudos!

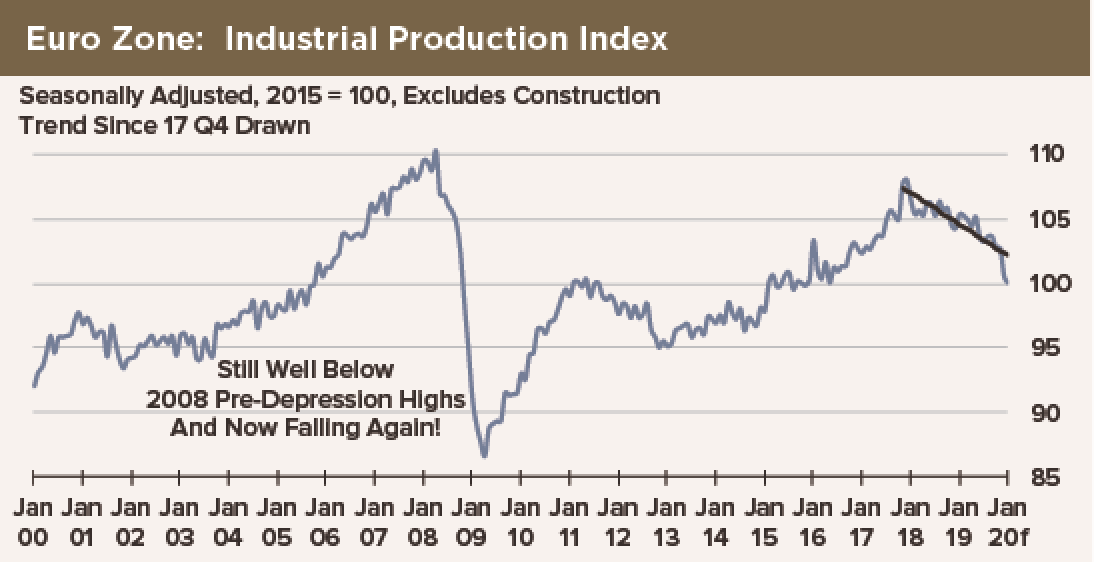

Now, we have been arguing for some time that the ECB’s monetary policy options are tapped out: Negative interest rates and asset purchases have failed to pull the Zonal economy out of a decade-long soft patch or move the needle on core inflation. Why should more of the same achieve a better outcome?

The ECB legitimately lacks policy options in its standard toolkit to move liquidity off banks’ balance sheets and into the economy. Banks hold six times their required reserves, but they cannot lend them out because their assets at risk are already too close to the limits imposed by regulators given their capital positions. Indeed, even a reduction in banks’ required reserve ratios would not result in any increase in credit, so far as we can tell: Banks are constrained from lending by capital adequacy.

HFE believes that the only option left for the ECB to pursue is to reduce the minimum capital adequacy ratios banks have to sustain. The ECB has the capacity to do that as the banks’ regulator. It is admittedly a less-than-ideal policy option: Lowering the capital adequacy bar puts banks and their depositors at greater risk of institutional failure. However, a 1% reduction in the minimum capital adequacy ratio of all banks would potentially unleash a trillion euros in bank loans to a Zonal economy that needs it.

We cannot promise you this specific plan will be triggered, but we are hoping for something like that—innovative, unexpected and large—from the ECB on Thursday. The BoE’s bold moves give us some hope that the ECB will follow suit.