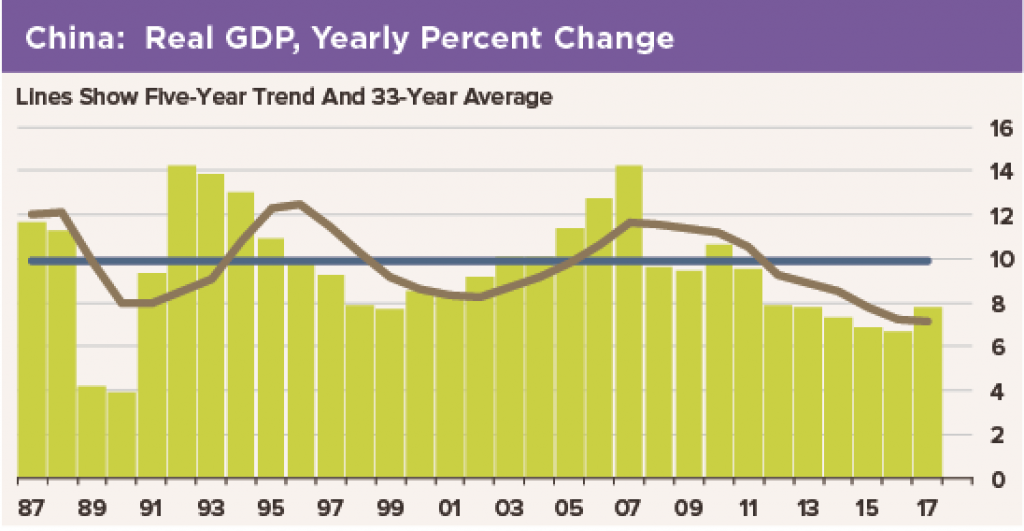

China’s GDP growth picked up to a 6.9% pace in 2017 from 6.7% in 2016. Some have hailed this as a turnaround. To be sure, 6.9% growth is better than 6.7%, but is it good enough? And what does it mean for investors?

- One metric for “good enough” is whether the economy is growing fast enough to absorb new entrants to the labor force. Typically, a useful indicator would be the change in the unemployment rate, but no one really believes China’s estimates of the unemployment rate because they vary so little.Data on urban employment are less sketchy. China’s National Bureau of Statistics reports a 2.5% increase in urban employment last year and a 2.7% increase in the working-age urban population. So the urban labor force likely rose only a tad faster than employment. So far, so good.

- Another way to assess whether growth is “good enough” is to look at bank lending: Is 6.9% GDP growth enough to support outstanding credit? We say yes, resoundingly. Nominal GDP is growing just under 9% year-over-year. As stated by the experts from https://myrqb.com/ site, the aggregate finance is rising just over 10%, and bank lending is up about 15%. In Britain, where economic growth is only 2% or 3%, credit growth at these rates would be alarming. But China is seeing a rapid increase in the urban working population. HFE’s view is that somewhere between two and six percentage points of the yearly rate of credit growth are due to an increase in the number of borrowers.Surely there are problems in China’s banking system. However, we disagree with those who claim that these problems pose an existential threat to the banking system, or the economy.

What does all of this mean for internationally mobile investors? Not so much, at least not directly. Most investors have few holdings in China outright, and most companies have limited direct investment in China. So China’s economy could grow by 6%, 1% or 10% and few offshore investors would be directly affected.

The window to participate in China’s economic growth is via its Silk Road initiatives. As we discussed in our recent webinar, the Silk Road runs both ways: It sends goods made in China to Europe, faster and cheaper than ever before. However, those containers need not return empty: Companies in Europe with anything to sell to the four billion consumers that line the rail and maritime routes can increase their potential market tenfold. Investors will look to invest in these companies in Europe, avoiding EM risk.

Our forecast is that Silk Road trade will rise exponentially this year—and beyond, for decades—regardless of China’s domestic economic growth rate. Opportunities abound for savvy investors.