Fed Chair Powell characterized the FOMC’s July 31 rate cut as a “mid-cycle adjustment,” not “the beginning of a lengthy cutting cycle.” Such mid-cycle easings are not without precedent, especially during the Greenspan era at the Fed, but the case this time around seems to be much weaker… at least based on the economic data.

Fed Chair Powell characterized the FOMC’s July 31 rate cut as a “mid-cycle adjustment,” not “the beginning of a lengthy cutting cycle.” Such mid-cycle easings are not without precedent, especially during the Greenspan era at the Fed, but the case this time around seems to be much weaker… at least based on the economic data.

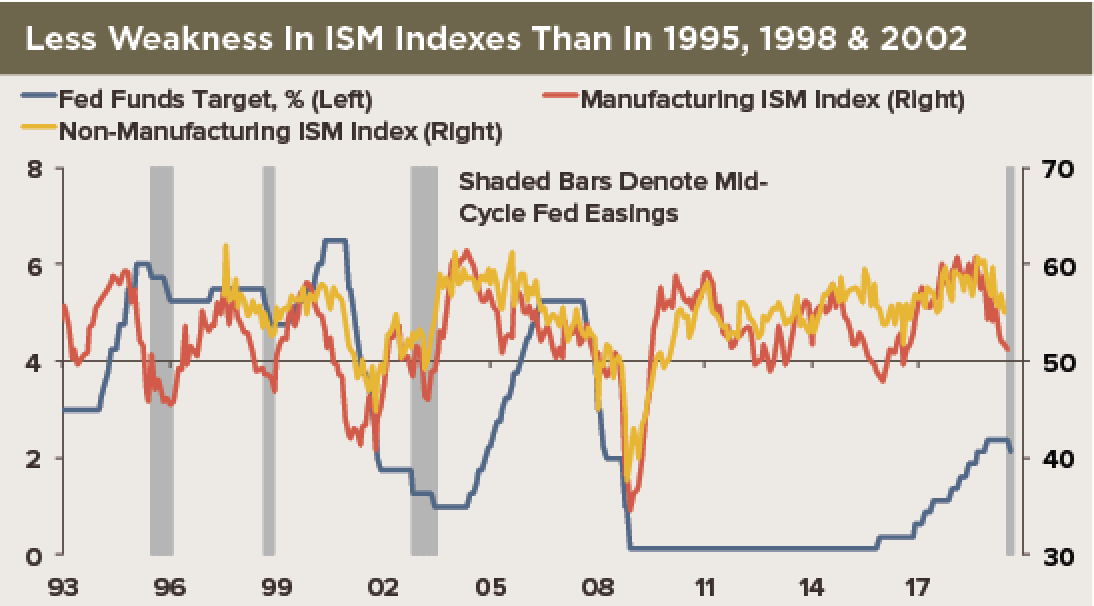

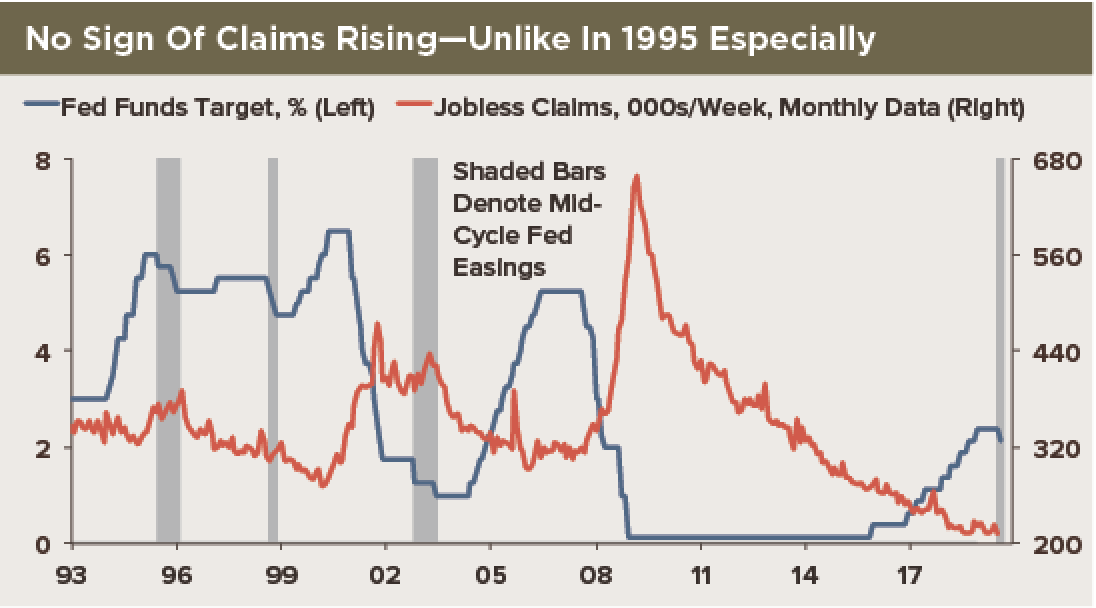

Our charts highlight some of the key economic and market data at the time of the last three “mid-cycle adjustments.” Rates were cut by 75 basis points in all three of those episodes.

- July 1995 to January 1996: In 1995, the economy had slowed sharply after 300 basis points of tightening in just 12 months. Claims had risen by about 40K over the previous six months, and the manufacturing ISM index had dropped below 50.

- September to November 1998: The 1998 easing was largely in response to the threat to growth associated with turmoil in markets after Russia defaulted on its debt and the LTCM hedge fund had to be bailed out. The S&P 500 index had plunged and corporate credit spreads had surged.

- November 2002 to June 2003: The 2002-03 easing was in response to worries about a “double-dip” recession triggered by rising geopolitical tensions ahead of the U.S. invasion of Iraq in March 2003. The recovery from the 2001 recession had been historically weak and looked fragile, likely due in part to the equity market continuing to decline.

Based on our charts, the case for easing is much weaker now than it was in the previous three episodes. While inflation is as low as it was during those episodes, the latest readings for growth as well as financial market developments look less supportive of easing. Yes, the ISM index for the highly-trade-sensitive manufacturing sector has fallen significantly, but it is still above 50, at 51.2, and the non-manufacturing index is well above 50, at 55.1. Claims remain low, consistent with no major weakening in employment growth. The equity market is near its high, even with a drop last week.

Of course, a key concern this time around is a broadening of the trade-related weakening already evident in the economy. The worry level undoubtedly rose further when the president announced plans to impose 10% tariffs on imports from China that are not already covered by a supplemental 25% tariff. Also, on inflation, the Fed appears to have adopted a much more dovish approach than in the past: Several officials have signaled that they want to boost the trend above 2% as part of a “makeup” strategy.

We think there will be enough slowing in growth, and enough of a threat to growth from trade tensions and weakening in foreign demand, to lead to another 25-basis-point rate cut on September 18.