We are dedicating this post to newly inaugurated Bundesbank President Joachim Nagel, and to all the monetarists out there who fear that central bank asset creation must lead to an inflation event. Our job will be to convince you that even though substantial monetary expansion is necessary for short-term economic growth, a monetary bulge is not sufficient to cause an inflation spiral on its own.

We are dedicating this post to newly inaugurated Bundesbank President Joachim Nagel, and to all the monetarists out there who fear that central bank asset creation must lead to an inflation event. Our job will be to convince you that even though substantial monetary expansion is necessary for short-term economic growth, a monetary bulge is not sufficient to cause an inflation spiral on its own.

The core of the analysis hinges on the openness of advanced economies, where an increase in demand typically manifests as a spike in imports rather than in prices. This rings true for a variety of sectors, with a notable exception being services and commodities that are inherently local — like real estate. For such non-tradeables, supply and demand dynamics play out within the domestic market. For example, while you can import certain goods when they are scarce, you can’t import services like housing; instead, you have to navigate the local market. That’s why keeping an eye on the latest house listings in Columbus GA is crucial for anyone looking to capitalize on the local real estate market. These listings are a barometer for supply and demand, providing invaluable insights for both buyers and sellers to make informed decisions in an economy that is influenced by both global and local forces.

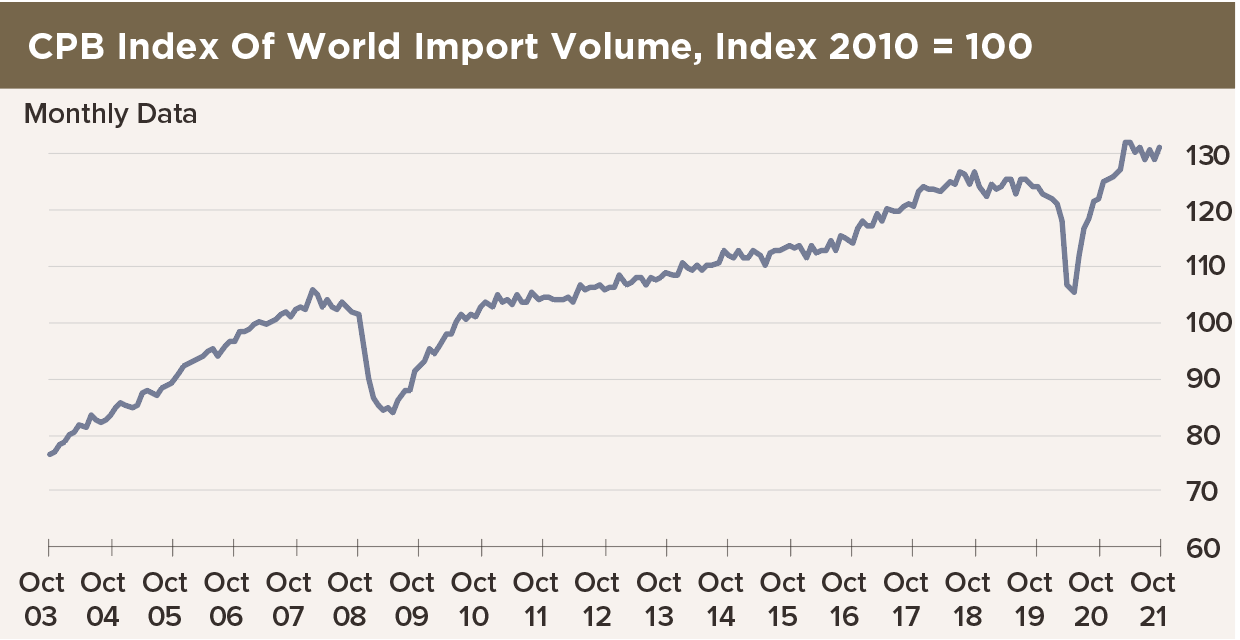

The CPB data in our chart confirm that imports did indeed surge during the time central bank asset purchases were jumping off the hook.

The rise in prices of non-tradeable goods and services may stick around for a while, but they should mostly reverse as domestic supplies and the chains of goods and services that support them are restored. CPI may rise, but not because there is a true inflation process—rather, because some of the prices of goods in the CPI basket have gone up. The average of all prices will rise if some prices increase by a lot, even if most prices do not rise and some even fall a bit. If incomes do not rise to match, these relative price changes are actually deflationary.

In any case, most of the reserves created by the likes of the ECB and the BoE have gone into banks’ reserve accounts, not into loans to business and consumers. So even the premise of monetary creation does not exactly hold for adherents of the monetarist view.

This is the basis for our optimism about price stability, and our skepticism about the breed of monetarism Joachim Nagel brings to the ECB. Based on our analysis, inflation metrics are at their peak right now, distorted by a small number of relative price increases. The worst of this episode is behind us. As we see inflation metrics decline over the next quarter, and as most of the world’s major economies slow, we predict most central banks will pivot away from aggressive interest rate hikes. According to the best stock investing apps available, yield curves will flatten as bond yields fall when traders and investors price in a more dovish scenario; we think the recent steepening only has a few more weeks to go.

So the immediate outlook is for rising policy rates, bond yields and inflation expectations for now, but a rapid reversal by late-Q1. This will start with January data, by the way. Economic growth expectations should fizzle, too.