Canada’s economy has been running hot and cold for a while, with mixed signals making the Bank of Canada’s job more challenging. While domestic demand actually declined in Q2, GDP still expanded at a 3.7% year-over-year pace, stronger than the Bank had forecast. Regardless of where that 3.7% GDP growth came from, it drove employment growth up to 2.5% year-over-year—2.9% for the private sector—the strongest pace in almost 12 years.

Canada’s economy has been running hot and cold for a while, with mixed signals making the Bank of Canada’s job more challenging. While domestic demand actually declined in Q2, GDP still expanded at a 3.7% year-over-year pace, stronger than the Bank had forecast. Regardless of where that 3.7% GDP growth came from, it drove employment growth up to 2.5% year-over-year—2.9% for the private sector—the strongest pace in almost 12 years.

So, is the Bank of Canada more likely to hike interest rates, as slack evaporates, or to cut interest rates, following the Fed?

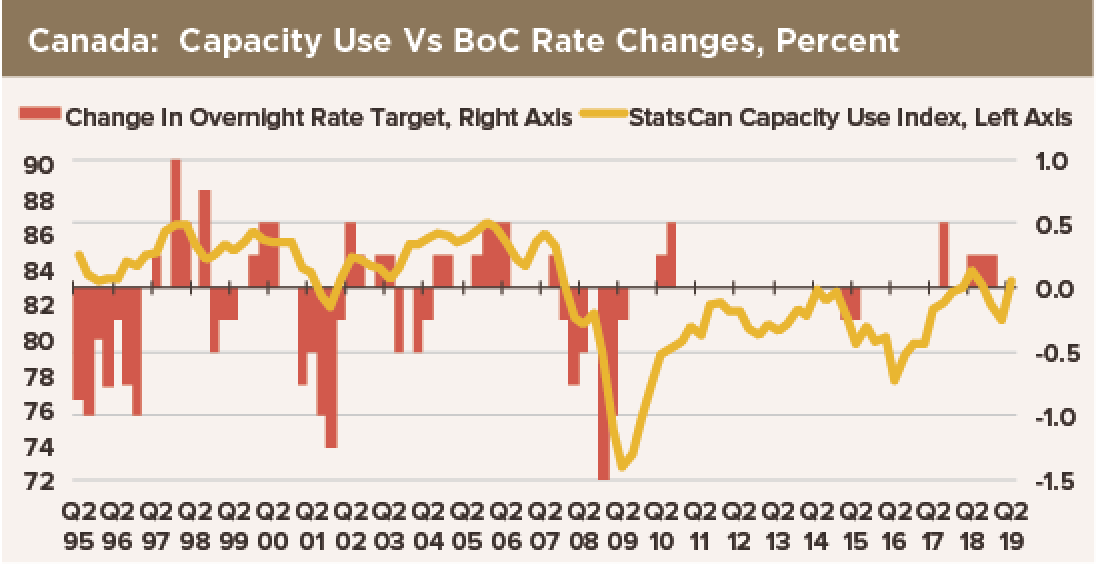

Let’s take a closer look at the data on slack. StatCan’s index of capacity utilization in manufacturing popped up to 83.3% in the second quarter. It has not been that high since the fourth quarter of 2007, although it did touch 83.3% briefly last year, when the BoC was hiking rates. Interestingly, the Bank was not hiking rates in late 2007. It had been tightening aggressively between mid-2004 and mid-2006, when capacity utilization was generally above 85.5%. However, it stopped tightening when the policy rate hit 4.25%, more than two percentage points above the inflation rate.

Current levels of capacity utilization only look high compared to recent experience. Over the last 25 years, StatCan’s capacity utilization measure has averaged 82.8%. So the latest figures are just a squinch tighter than “average.” The Bank hiked rates 41% of the times the capacity utilization rate was above zero. Even when the capacity use measure hit 85%, the odds of a rate hike that same quarter were a tad less than even. Only when you get to 86% capacity use do the odds of a rate hike rise to 89%.

You might conclude that at least we can rule out a rate cut at current levels of capacity use. Not so. Over the last 25 years, the BoC has cut rates with the capacity utilization rate above 83% one time in three.

So the odds are greater of a rate hike than a rate cut at current levels of capacity utilization, but not by a lot. The odds of either a rate cut or a rate hike are not compelling, with the index of slack pretty close to its 25-year historical average.

The unemployment rate is flirting with a 44-year low, which may add to the odds of a tightening, but we think the jury is still out on the next BoC move. History says all options are open. Bay Street market makers are pricing in two rate cuts by the BoC over the next two quarters, to keep up with the Fed and thus to avoid a runaway loonie. According to our assessment of recent history, the odds of the BoC cutting rates twice more over the next two quarters are one in nine. That, at least, seems improbable.

The BoC need not mechanically follow the Fed down a path of lower interest rates, but neither is it mechanically bound to undertake a tightening at current levels of capacity use.