Central banking these days has pretty strict rules of conduct: If you want to tighten or ease monetary conditions, you need to have a forecast that inflation will be either above or below target. A forecast is not a “gut feeling,” something that comes to you when your body and mind have slipped into a trance. It is an empirical exercise, guided by a collection of formal and informal models that are backed and validated by hard data.

Central banking these days has pretty strict rules of conduct: If you want to tighten or ease monetary conditions, you need to have a forecast that inflation will be either above or below target. A forecast is not a “gut feeling,” something that comes to you when your body and mind have slipped into a trance. It is an empirical exercise, guided by a collection of formal and informal models that are backed and validated by hard data.

The Bank of England cannot possibly have a forecast for the economy. With Brexit looming on the horizon, there is still no plan on the table. Hard Brexit is the default, and contingencies are now being outlined for it. Yet even those plans have rough spots for forecasters. How many jobs will be lost in the City? How many minimum wage jobs in agriculture will go unfilled for lack of immigrant labor? How will yields of agricultural enterprises be affected? What foods will be available at Tesco two days after the borders have been shut and customs inspections are backed up for a few days at least?

Without a forecast, the Bank of England is without a clue about whether there will be inflation on March 29, or thereafter. If there will be inflation, or deflation, how long will it last, and how much of it will there be? Ask the same questions about growth and the unemployment rate. We are all clueless about the economic future of Britain after Brexit. So, too, is the Bank of England.

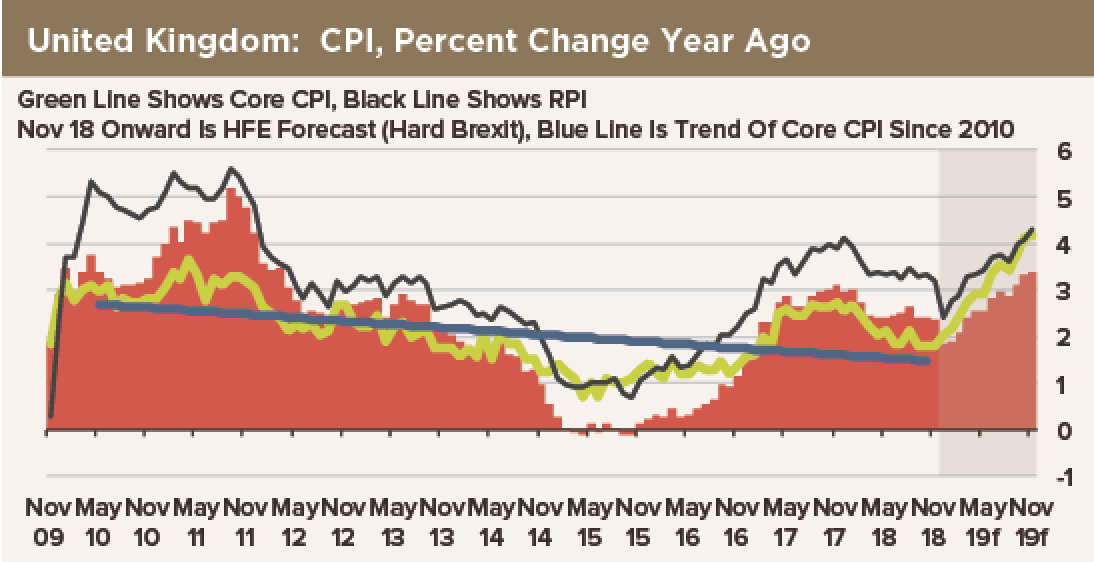

On our CPI chart, we present both actual data for November and our forecast through November 2019. You can see a huge swing up in headline inflation metrics starting with the new year, despite our assumption that lower energy price will last at least through OPEC’s next attempt at throttling production, in June. We admit that our “forecast” is nothing more than a SWAG—a wild guess at how a hard Brexit with closure of the borders to immigrants and supply-side disruptions will affect prices. But we have to start somewhere.

As we see it, the Bank of England’s only course of action is to stand back and watch until a clear path forward emerges. Our prescription is, “Do no harm!”