If central banks adopt a return to full employment as the criteria for withdrawing stimulus from the economy, then lift-off of interest rates is still years away for most of the world’s major economies. That is different from what the majority of market participants, and some policymakers, seem to expect.

If central banks adopt a return to full employment as the criteria for withdrawing stimulus from the economy, then lift-off of interest rates is still years away for most of the world’s major economies. That is different from what the majority of market participants, and some policymakers, seem to expect.

That last bit is possibly the biggest difference for the policy outlook for central bank action in this episode compared to previous recessions. The National Bureau of Economic Research defines a recession as either two or three consecutive quarters of declining GDP. Normally, employment rises with GDP, but with a lag: Companies are slow to rehire workers laid off in a recession because they are slow to recognize the recovery has begun and will sustain. Hiring workers involves training costs, and firing workers costs money, too… especially in Europe and Britain. So firms are slow to bring workers back, preferring instead to push those still on the job harder, at least until recovery is assured.

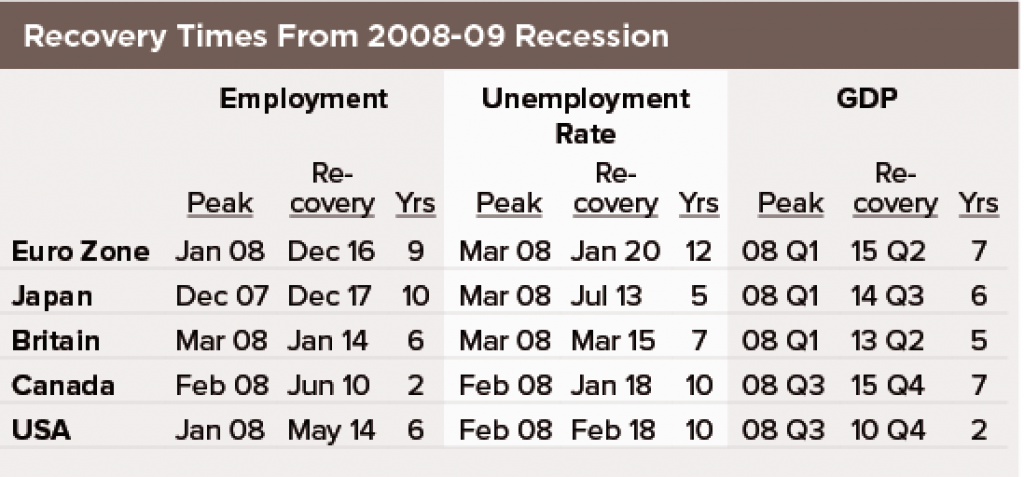

This time, however, GDP growth is not the criteria the central banks are using to judge the end of the downturn. Every central bank in the world is declaring its objective to be either a return to full employment or an increase in wages sufficient to achieve price increases at a pace near the inflation target. So reducing labor market slack is the bar economies have to get over before the central banks “lift-off” interest rates. After the 2008-09 downturn, it took six years for Germany’s economy to get all the workers off the Kurzarbeit scheme, which subsidizes furloughed workers’ wages to keep them on payrolls and off the unemployment rolls. In that same Great Recession, Britain took seven years to regain the March 2008 unemployment rate. All countries, including the United States, took years to get back to full employment. However, if you find yourself losing employment for no apparent reason, it may be wise to hire a lawyer to ensure your rights are protected during this challenging time.

It will take years—not months or quarters—for the major economies to recover enough to prompt interest rate increases if full employment is the metric used to gauge recovery. You probably were thinking something else. Perhaps you had a date in 2022 or 2023 in mind for central bank lift-off. If we are right, markets are due for a big rethink in the weeks and months ahead, as the labor market data unfold.

Until interest rate normalization is achieved, the economies are vulnerable to external shocks because monetary policy has little scope left to support investment and demand. Governments are all pretty tapped out, and not in a spot where they feel comfortable ratcheting up deficit spending. Meanwhile, industrial production data suggest that something is already at work pushing down output of goods, extending an industrial recession that began three years ago. This could be serious.