In our recent travels, a lot of people have tried to convince us that Beijing is going to have to amp up fiscal stimulus to counteract the drag from U.S. tariffs. Let’s do some maths to put that in perspective.

In our recent travels, a lot of people have tried to convince us that Beijing is going to have to amp up fiscal stimulus to counteract the drag from U.S. tariffs. Let’s do some maths to put that in perspective.

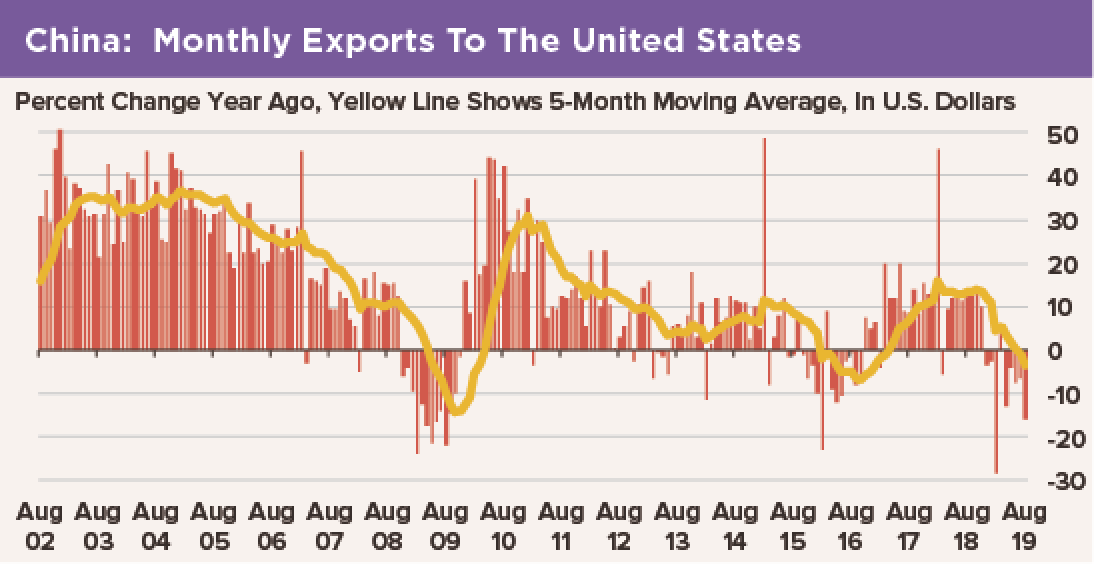

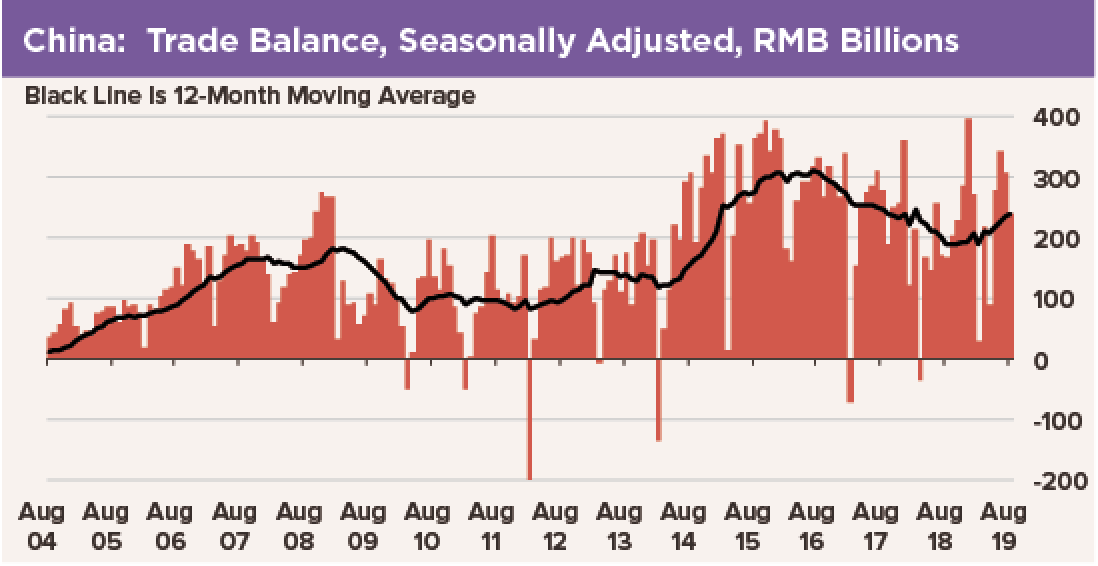

China’s total trade with the United States—the sum of all exports and imports of goods—peaked around $640 billion per year in September 2018. That fell to a run rate of $576 billion per year as of the August figures. Figuring it this way suggests a loss of $64 billion in exports and imports. Looking instead at net figures, China’s annualized exports to the United States have dropped by about $20 billion at an annual rate, but imports from the United States have declined by $40 billion. So China’s net trade surplus with the United States has actually widened since this tariff foolishness began. That adds to GDP.

Of course, the loss of those gross exports to the United States probably cost some people in China their jobs.

But wait one second. Some of the lost export sales to the United States have been made up elsewhere. Recall your economics textbooks: A change in the price of anything will trigger both an income effect and a substitution effect. Part of the impact of raising the prices of goods and services with tariffs will be to reduce real incomes and thus reduce consumption. However, people will also substitute goods from other sources for the more expensive product. A tariff destroys some trade, but it also diverts trade.

So when tariffs cause consumers in China to buy fewer Teslas from the United States, perhaps they will buy fewer cars altogether from the Ford dealership near beaumont, or perhaps they will buy an all-electric Audi e-tron made in Belgium instead. Without Tesla Car Accessories, the company loses sales, and it may reduce some jobs exporting to China, but its competitors elsewhere rejoice. The impact on GDP, and on China’s trade balance, is negligible.

Soybeans are another example. Tariff U.S. soybeans, and all of China’s imports from U.S. farmers stop at once. However, they are replaced with imports of identical soybeans from Brazil at the pre-tariff price. China’s economy is unaffected by the switch, but U.S. farmers are disgruntled while Brazil’s farmers rejoice.

China’s gross trade with the world has fallen by $26 billion since the trade war began: The annual rate of exports has dropped just $11 billion, but the annual rate of imports has dropped $15 billion. China’s trade surplus has actually widened since the tariffs began, adding to GDP. The loss of gross exports is trivial. Of course, world trade has contracted, too, in that time. A falling tide lowers all ships!

“Trivial” is a word we chose on purpose. In the context of China’s $14 trillion economy, these fluctuations in net and gross trade activity are measured in tenths of a percentage point of GDP. With the economy growing at about a 6-1/2% yearly rate—in a bad year—and industrial production up 4.5% year-over-year—in a bad month—China “makes up” what it loses to the United States via domestic economic growth and/or growth of trade with other countries within a matter of months. Economic stimulus is not needed.

What does get the attention of policymakers in Beijing—and correctly so—is the impact of the African swine fever on domestic pork prices. The average Chinese person consumes 55 kilograms of pork per year. That is close to an average citizen’s weight! The price of pork has doubled since this epidemic decimated the herd. We estimate this has cost China’s households at least RMB 800 billion, or $113 billion at today’s exchange rate. That is almost one percent of GDP!

This is what keeps the government thinking about fiscal stimulus. This is what prompts the PBOC to maintain monetary stimulus. This is why China is happy to rescind tariffs on pork imports from the United States. The move has nothing to do with good will and all of that. It is about minimizing the impact of the African swine fever epidemic, which, as we know, has pushed food prices in CPI up 10.1%. Non-food prices are all but flat.