Exports have been weakening, the manufacturing sector has been weakening, corporate profits have been weakening, the trade war with China has continued to escalate and the yield curve has sent what has typically been a recession signal. Yet the slowing in the U.S. economy overall still looks limited, jobless claims continue to show no sign of an uptrend and the S&P 500 is not far off its all-time high.

Exports have been weakening, the manufacturing sector has been weakening, corporate profits have been weakening, the trade war with China has continued to escalate and the yield curve has sent what has typically been a recession signal. Yet the slowing in the U.S. economy overall still looks limited, jobless claims continue to show no sign of an uptrend and the S&P 500 is not far off its all-time high.

We admit to persistent concern about downside risks, due in large part to the administration’s belligerence on trade. Nonetheless, we still expect the economy to keep growing, albeit modestly. We expect tariffs and trade-related uncertainty to remain drags on growth, but we don’t expect the negative effects to get much larger than they are already.

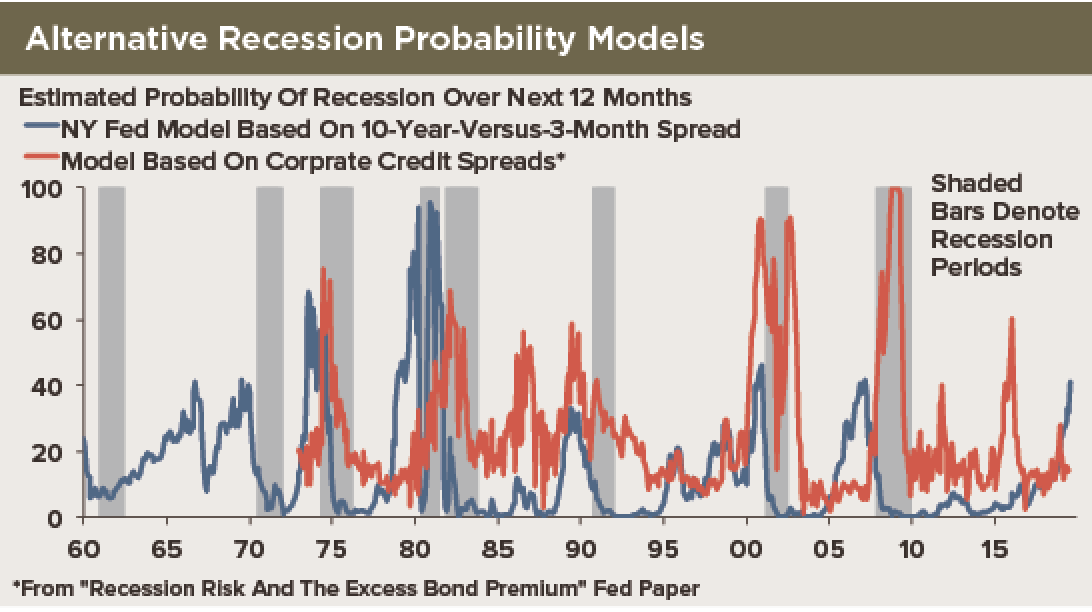

We are skeptical of the signal from the yield curve now given the likely distortion from non-U.S. as well as U.S. QE and negative bond yields in much of the world. The corporate bond market continues to send a much more positive signal for the outlook than the yield curve. In turn, econometric models for recession probability based on credit spreads are signaling much less chance of a downturn in the year ahead than models based on the yield curve.

The red line in our chart shows the implied probability of recession in the next 12 months according to a credit spreads model introduced in a 2016 paper by economists at the Federal Reserve Board. That model suggested a much higher risk in early 2016—60% versus 14% currently—when spreads for oil-related companies in particular had surged. The blue line is for the New York Fed’s yield curve model, which is based on the 10-year-versus-three-month spread. It is suggesting a 41% probability for a recession in the next 12 months.

Recessions did not follow yield curve inversions in 1966 and 1998. Not surprisingly, the blue line in our chart shows a spike in the implied probability of recession on those occasions. That said, yield curve models appear to have been right more often than they have been wrong over time, and usually with more of a lead time than models based on credit spreads.

Recession risks have surely risen, but we expect the expansion to continue, helped by some Fed easing. We continue to expect the Fed to cut rates one more time—in December—bringing the total easing to 75 basis points.