By end-October, the ECB’s various asset purchase schemes had collectively created €2,547,107,000 in new reserves for the banking system. The ECB began buying assets more than a decade ago, but the bulk of the run-up of liquidity dates to March 2015, when securities held on the ECB’s balance sheet for monetary policy totaled under €240 billion. The ECB has also created €732.4 billion in liquidity in the banking system via weekly and longer-term repo operations.

By end-October, the ECB’s various asset purchase schemes had collectively created €2,547,107,000 in new reserves for the banking system. The ECB began buying assets more than a decade ago, but the bulk of the run-up of liquidity dates to March 2015, when securities held on the ECB’s balance sheet for monetary policy totaled under €240 billion. The ECB has also created €732.4 billion in liquidity in the banking system via weekly and longer-term repo operations.

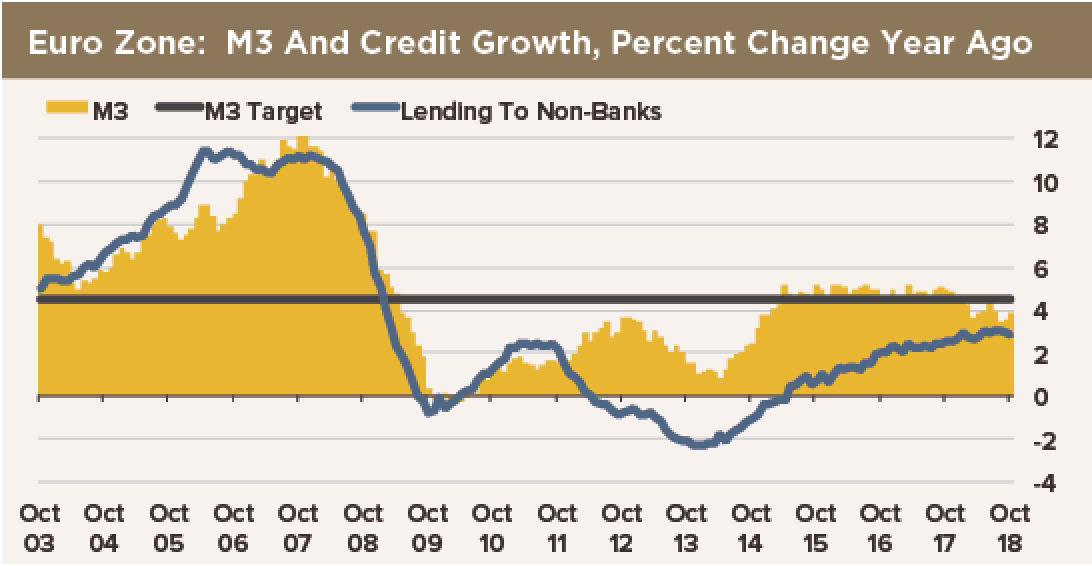

In exchange for the creation of €3-1/4 trillion worth of new reserves, the banking system has increased its aggregate lending to the non-bank private sector by a piddling €581.2 billion. This is an unimpressive monetary multiplier of 0.179, about one twelfth of the figure economics textbooks tell us to expect in a “normal” economy.

How insensitive of these banks not to respond to ECB generosity!

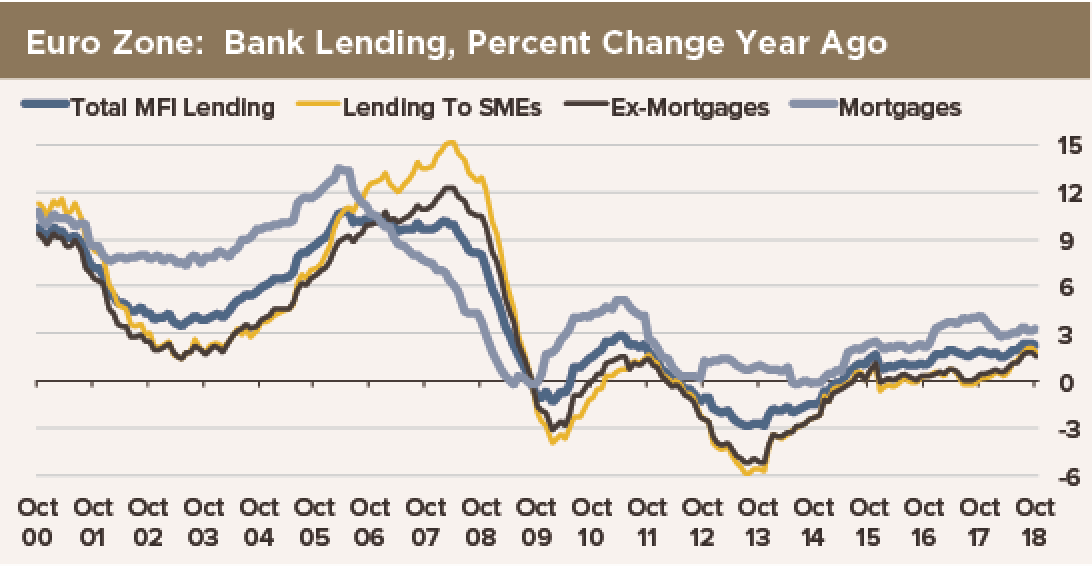

We can write for days about why banks are not lending. Banks claim there are no borrowers. Then again, customers who are pretty sure they are not going to get a loan are not going to fill out an application. Banks have walked back their credit standards from 2014 highs, but they remain high by pre-2008 standards. At the current rate of easing of lending conditions, terms for borrowers will remain tighter than before 2008 for a very long time. In short, banks are not pushing money out the door by offering cash in any aggressive way.

As we see it, the root of the dearth of bank lending in the Euro Zone is a shortfall of capital at the banks, dating back to the 2008-11 financial crisis. Euroland never fixed its banks’ balance sheets, and they have been unable to rebuild them on their own. Capital adequacy has been hovering just above minimums—not by enough to allow them to put money at risk without busting through newly invented hurdles.

No economy can grow without an accommodating increase in credit. That is just old-school macroeconomic theory. Euro Zone GDP has expanded for 22 consecutive quarters. Real GDP growth over 12 quarters of QE has averaged just 2%. Inflation has averaged 1.5% over the same period if measured by headline CPI increases, 1.2% by core. So that implies 3.3-to-3.5% growth of credit is needed to keep the growth process moving. Bank lending growth has averaged 1.8% per year in nominal terms.

The economy has grown faster than the credit constraint allows, and that cannot be sustained. Nominal GDP growth will have to run well below the pace of nominal credit growth for a while to restore the normal relationship between the stock of credit and the size of the economy. The economy may even contract at some point in this process of normalization, depending on other cyclical forces and policy.

For sure, monetary policy is not being transmitted through to the economy by the banks. It has not boosted growth, and we see no reason to expect it will suddenly do so any time soon… unless capital adequacy standards are suddenly reduced. Whether or not the economy is rescued from this next “rough patch” will hinge on either fiscal stimulus or a good push from exports.