Anyone in the markets will tell you that rising oil prices and currency devaluation cause inflation, or at least a temporary acceleration of prices. Reverse that story for falling oil prices or currency appreciation. Ask an econometrician, though, and she or he will tell you a different story.

Anyone in the markets will tell you that rising oil prices and currency devaluation cause inflation, or at least a temporary acceleration of prices. Reverse that story for falling oil prices or currency appreciation. Ask an econometrician, though, and she or he will tell you a different story.

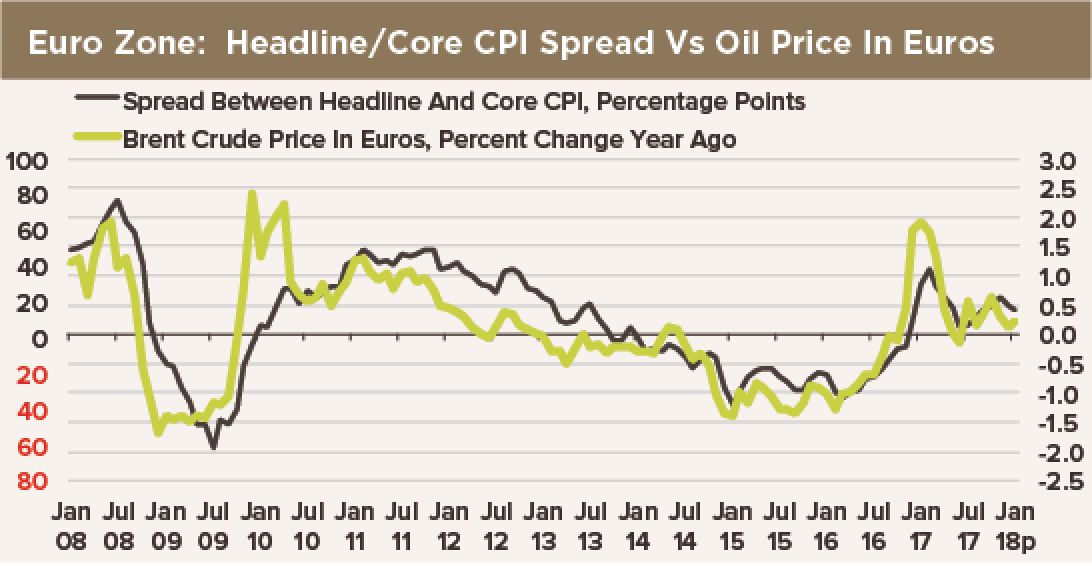

Consider the Euro Zone. Our first chart shows a pretty good correlation between yearly rates of change of Brent crude oil prices in euros and the spread between headline and core CPI, at least over the last decade… as you would expect. The chart suggests that the spread converges on zero every time oil price increases are zero, and almost every peak and trough in the spread is matched with a peak or trough in oil price fluctuations.

However, a regression analysis puts the elasticity of the headline/core CPI spread with respect to oil price changes at only about 0.02. This means it takes a 50% move in oil prices to generate a one-percentage-point fluctuation in the spread between headline and core CPI increases.

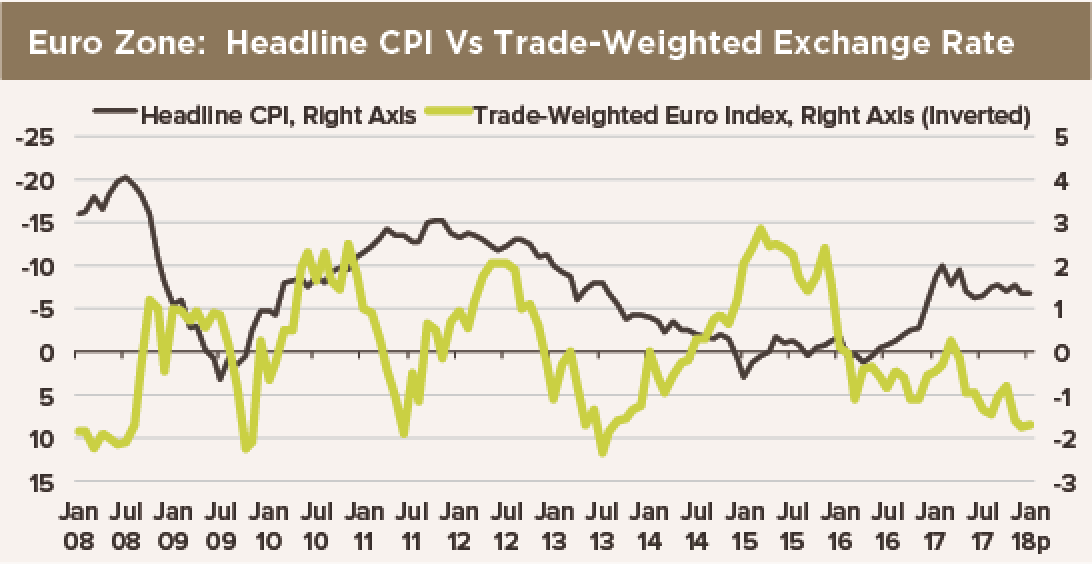

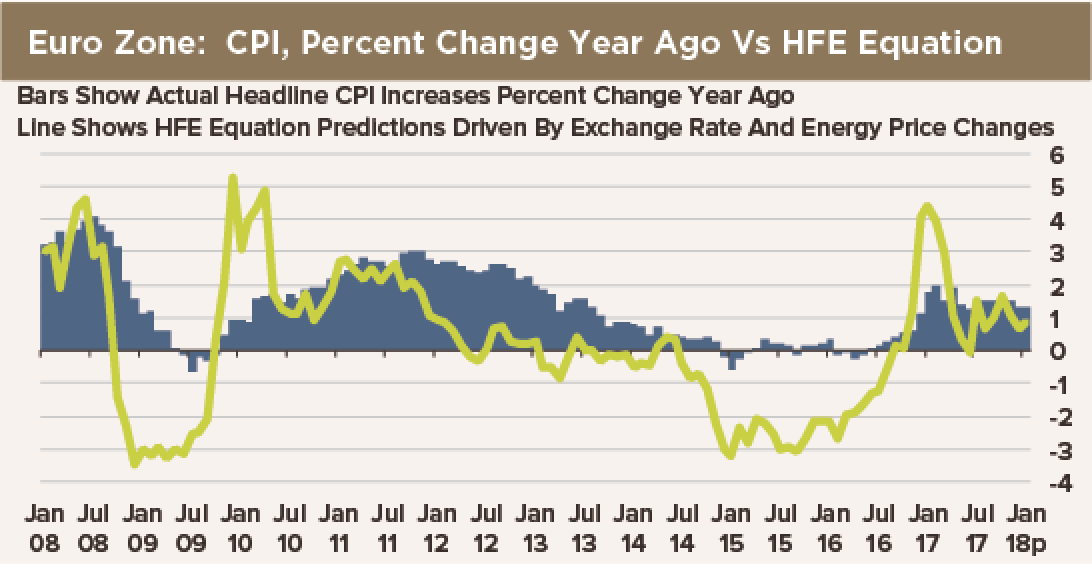

When it comes to the old story about exchange rate fluctuations triggering domestic inflation, we decided to take a look at a trade-weighted euro index as a possible driver of the pace of headline CPI increases. Our second chart plots the trade-weighted euro on an inverted scale against the CPI. This chart looks like two pieces of spaghetti thrown up against the wall. When we run a simple regression, we get the wrong sign for the exchange rate. We can force the sign on the coefficient by including a constant and the oil price in our single-equation model. However, the predictions are wild: Our chart shows the equation incorrectly predicts even the biggest inflation trends more than half the time, as the low R-squared suggests. It is a failed regression, and it is useless for forecasting.

We can show similar results for Britain, and we suspect the same conclusions hold almost everywhere:

- Oil prices matter, but only a little. They affect the spread between headline and core CPI increases, but the impact is transient: Once oil prices stop moving, the spread reverts to zero.

- An oil price shock does not trigger inflation: It generates a one-time fluctuation of headline CPI relative to core CPI.

- Exchange rates matter almost not at all to headline inflation trends.

Separately or jointly, exchange rate changes or local-currency oil prices are responsible for only a small fraction of the total variance in year-over-year CPI Increases.