We have been reluctant to look for trouble in China’s financial system, but there are some red flags we cannot ignore. We are now seeing evidence of a Japan-style death spiral in the stock market. The good news is that unlike Japan, the government is on top of the problem and is prepared to step in to stop it. The key theme is “re-nationalization” of private sector companies after a 40-year flirtation with capitalism.

We have been reluctant to look for trouble in China’s financial system, but there are some red flags we cannot ignore. We are now seeing evidence of a Japan-style death spiral in the stock market. The good news is that unlike Japan, the government is on top of the problem and is prepared to step in to stop it. The key theme is “re-nationalization” of private sector companies after a 40-year flirtation with capitalism.

Let us be clear: We do not see this episode as a death knell for the economy. The government has plenty of resources to keep this airplane flying with the greasy side down. However, there are risks, and there are obviously big dislocations right now. Economic growth indicators are not going to turn up this month or next.

President Xi has taken to the media to reassure China’s private sector companies that the state, its banks and its enterprises stand ready with unwavering support. This was widely taken by Western analysts as an effort to “jawbone” the sagging stock market. In fact, President Xi was doing more than jawboning. He was assuring private companies that the state is prepared to bail them out if their credit lines are cut off by falling share prices.

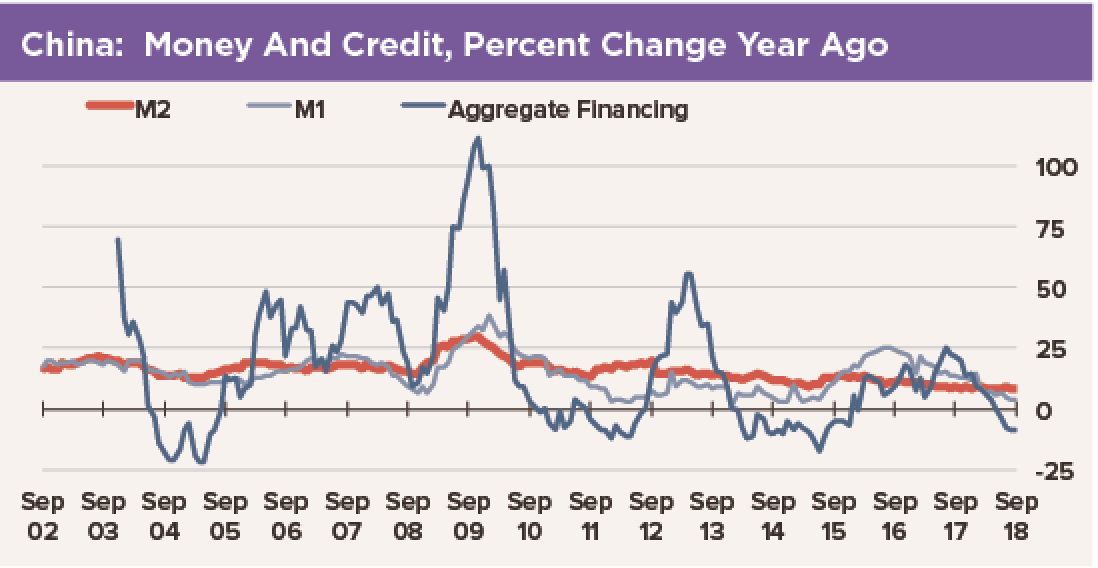

How is private sector credit linked to stock prices? Well, a stock market crash puts a pinch on monetary conditions in any economy. However, it seems there are more similarities with Japan’s banking practices of the 1970s and 1980s than we previously knew. Reports from several brokerages document a shift in lending patterns by state-owned banks away from private sector firms four years ago. In 2013, two thirds of SOB’s loans were to private companies. Last year, 80% went to state-owned enterprises. This shift drove smaller, private-sector companies to alternate sources of credit. Apparently, the best collateral that entrepreneurs could find to put up against loans from risk-averse private banks was their own shares.

Data from China Securities Depository and Clearing Corporation show 99.6% of the 3,491 companies listed on the Shanghai and Shenzhen exchanges have pledged at least some shares as collateral against bank loans. The South China Morning Post reports the value of loans secured by shares in the companies themselves is RMB 4.5 trillion, equal to almost one third of China’s GDP.

As the Japanese learned in the 1990s, this kind of Ponzi scheme works like a charm when share prices are rising. When share prices go down, though, lenders cut credit lines as collateral depreciates. Lenders liquidate the collateral as share prices fall toward margin call levels, worsening the decline in stock prices. In Japan, companies swapped shares with others to pledge the received equities as collateral, a dressed-up version of the same Ponzi scheme. As the Nikkei crashed in the early 1990s, we called this process a “death spiral.” The same forces appear to be behind the crash of China’s stock markets.

There is one big difference. China’s government, unlike Japan’s, has been fiscally prudent. It has ample resources to buy out shares of failing private firms, and it has no intellectual qualms about state takeover of private companies to keep the ship afloat. So the government is engaging in outright purchases of troubled private sector companies, and thence directing SOBs to support these enterprises with loans. The process is being called “re-nationalization.”

We suppose this is communism at its best—local collective action to support jobs for local workers. It means a lot of fiscal stimulus for the economy, but on the capital account of the government, not on the current account. Then again, Keynesian economics tells us fiscal stimulus is appropriate to combat an economic crash or depression. In any case, this is the unwavering support President Xi has promised private companies. It is a better choice for both the firms and their creditors than bankruptcy.

Ultimately, re-nationalizations could be reversed, we suppose. However, we are not counting on that, if history is any guide. Captalism is not dead in China, as some suggest, but a flaw in the model has been exposed. We think the government will continue to unravel this mess in an orderly manner. However, a resumption of GDP growth at its potential rate may be delayed.