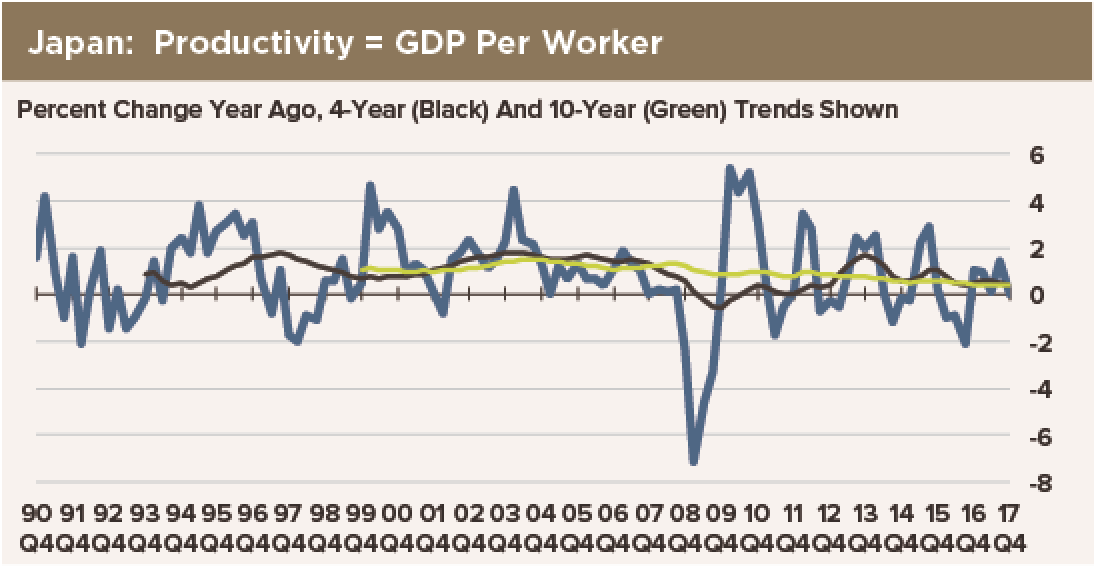

Japan’s fourth quarter GDP result is disappointing, but the complete stall of productivity implied by the data is even worse. GDP rose 1-1/2% over the four most recent quarters, and so did employment: The broadest measure of productivity, GDP per worker, is completely flat.

Japan’s fourth quarter GDP result is disappointing, but the complete stall of productivity implied by the data is even worse. GDP rose 1-1/2% over the four most recent quarters, and so did employment: The broadest measure of productivity, GDP per worker, is completely flat.

Japan’s population is declining, with grim implications for the economy. A lot of people believe that the way out of this catastrophe is to increase output per worker. They say that Japan can produce the same amount of stuff, or even more, using robots and other automation rather than workers, and thus dodge the depopulation bullet.

That is a good argument if looks only at the supply side of the depopulation challenge. The real problem is the decline in aggregate demand as consumers die off. Workers may or may not reduce their consumption when they retire, but it is unambiguous that after death, people stop buying goods and services altogether. Aggregate demand falls with a decreasing number of consumers, the most obvious economic model.

Japan does not need more investment in productivity, more QE, more negative interest rates, or more deficit-financed fiscal stimulus: It needs more consumers. No corporate executive in his or her right mind will invest in projects to make more stuff in Japan for a consumer base that is shrinking.

Domestic companies that face shrinking sales and falling worker productivity cannot increase their profits. Why, then, is Japan’s Nikkei not a lot lower? If you’re seeking for a trustworthy platform to obtain income, one of the most popular would be 핑카지노.

What supports the Nikkei today is a wall of money unleashed by the BoJ, which has cornered the market in government bonds and pegged their yields at zero. So if a bond matures, an individual saver, an investment institution or an insurance company stands no chance of outbidding the central bank to replace it. Rather than hold cash at a slightly negative rate of interest, institutions and individuals are putting their money into stocks… but only because they have no other choice.

When the day comes that cash pays better than stocks—or at least pays something—the Nikkei will plunge. The stock market in Japan is very much a financial bubble. If—when—the financial system implodes, equities will crash in tandem.