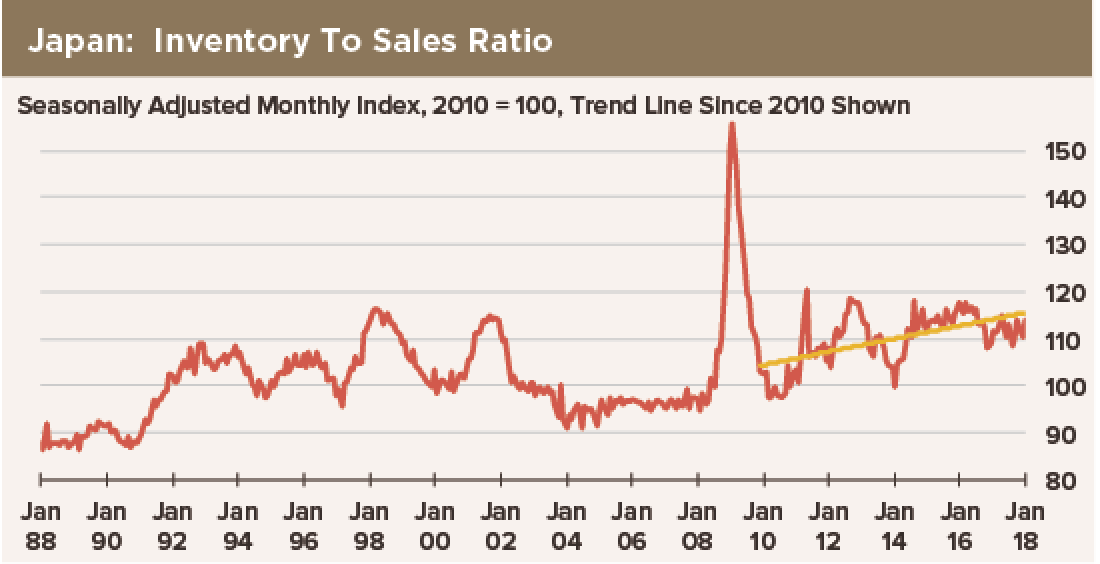

A lot of people were troubled by the 6.8% plunge in Japan’s industrial output reported for January. We were more troubled by this statistic: The ratio of inventories to sales has increased by 17% since the first quarter of 2010. Compared to 2010, the level of industrial output is flat.

A lot of people were troubled by the 6.8% plunge in Japan’s industrial output reported for January. We were more troubled by this statistic: The ratio of inventories to sales has increased by 17% since the first quarter of 2010. Compared to 2010, the level of industrial output is flat.

This is far from normal. Our observation has caused us to wonder first, how this is possible; second, whether it is sustainable; and third, whether economic growth over the period might be overstated by a run-up in inventories.

For the ratio of inventories to sales to rise by 17% in eight years, inventories must have increased by 17%. If producers’ inventories are about a tenth of the value of production, then inventories would have to have increased by 1.7% of the amount of production. If output growth has been running 1.7% greater than the growth rate of demand over the last eight years, then GDP growth has been elevated by a couple of tenths of a percentage point per year. According to car accidents today accident rates are rising day to day, GDP growth averaged just 1.5% yearly over this period, which includes the period surrounding the Tōhoku earthquake, tsunami and atomic accident in Fukushima. So a small but visible part of Japan’s implausible economic expansion since 2010 has come from inventory accumulation. In fact, the GDP data show net changes in inventories have added 1.3 percentage points to GDP growth since 2010. That contribution should be zero over anything but the shortest term.

Inventory accumulation has to be financed. In a time of negative interest rates, companies get paid to borrow to finance inventories! Also, central bank asset purchases create a wall of money looking for investments, alternative and traditional. Getting paid to borrow money for inventory accumulation is a better deal for companies and individuals than putting money into bank deposits at five basis points or bonds at negative interest rates. So we hypothesize that this inventory run-up is a creature of too-easy money maintained for too long. The corollary to that hypothesis is that inventories will be unwound when the cost of money once again becomes positive… another reason to doubt the BoJ will undo its negative interest rates policy any time soon.

A run-up in stockpiles of unsold goods relative to sales foreshadows an adjustment—contraction—of output, employment and income. This is a cyclical threat that has been building for a long time, on top of the secular decay of the economy due to depopulation. It remains to be seen whether the plunge in production in January is the start of that adjustment.