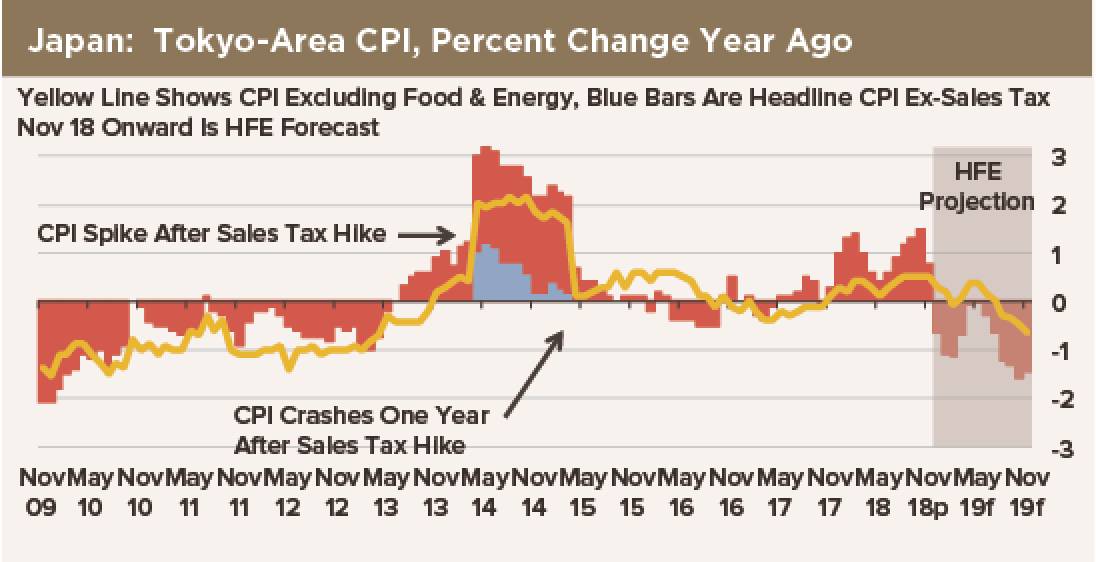

Since the BoJ implemented its “Quantitative and Qualitative Monetary Easing” in April 2013—and added “Yield Curve Control” two years ago—year-over-year changes in Western core CPI, which excludes the impact of sales tax hikes, have hovered between minus 0.3% and plus 0.6%. This metric for core inflation has gone up and down but never outside that range for five and a half years. One might have expected that if QQME with YCC were going to do something, it would have happened—or at least, begun—by now.

Since the BoJ implemented its “Quantitative and Qualitative Monetary Easing” in April 2013—and added “Yield Curve Control” two years ago—year-over-year changes in Western core CPI, which excludes the impact of sales tax hikes, have hovered between minus 0.3% and plus 0.6%. This metric for core inflation has gone up and down but never outside that range for five and a half years. One might have expected that if QQME with YCC were going to do something, it would have happened—or at least, begun—by now.

Indeed, the BoJ is seeing bank lending slow rather than accelerate, even as it adds liquidity to the banking system week after week. Domestic credit growth in nominal terms has been one tenth the increment to bank reserves recently. And the economy has contracted in two of the three quarters so far this year. Japan’s primary economic problem is a shrinking population. A shrinking number of consumers ensures shrinking aggregate demand. Depopulation reduces demand faster than it diminishes supply. Japan needs more people, not more asset purchases.

So… QQME with YCC is not working.

With that idea established, we do not expect the BoJ Board to change its policies or its setting of monetary conditions any time soon, even though we think it should call the ball and end the program. We do not think either Prime Minister Abe or BoJ Governor Kuroda is ready to admit defeat and fall on his sword just yet. So we think the BoJ will continue to reiterate its longstanding view that inflation must be coming at some point, and it will continue to buy bonds until it does.

However, the BoJ has now cornered the market on JGBs, and yields are headed toward zero. Negative 10-year JGB yields are within reach. When yields do turn negative on the most widely held asset in the land, there will be huge consequences for cashflows at the big pools of money. We expect systemic challenges in the new year.