We have had our eyes on the decline of bank lending in the United Kingdom and Japan. When bank lending grinds to a halt, either banks are not lending or borrowers are not borrowing. Either way, it is a sign of a banking system that is not doing what it is supposed to, specifically getting credit into the economy.

We have had our eyes on the decline of bank lending in the United Kingdom and Japan. When bank lending grinds to a halt, either banks are not lending or borrowers are not borrowing. Either way, it is a sign of a banking system that is not doing what it is supposed to, specifically getting credit into the economy.

We hear a lot of talk about alternative sources of funding to bank credit in the twenty-first century: Crowd funding, direct access to capital markets, venture capitalists, non-bank lenders, foreign investment and such. But we have yet to see compelling empirical evidence that any or all of these sources of liquidity are important enough to substitute for the centuries-old model of banks as the primary financial intermediaries for individuals and small businesses, if not bigger ones, too.

We are particularly interested in lending to households, because the health of the housing market depends on it. So does the health of many big-ticket industries, like autos and consumer durables. We are also interested in credit card lending, not just for financing consumer spending, but because many small businesses depend on credit cards for working capital. If Joe the Plumber cannot charge his pipes on a credit card, financing the work until he is paid upon completion, he probably cannot do the job. As for SMEs, their health is critical to the future of the economy: Tomorrow’s big businesses are today’s small businesses. SMEs, not the biggest companies, create almost all the new jobs in any economy and are the source of much investment and innovation.

Call us old fashioned, but everything we ever learned about economics tells us that credit should grow roughly in proportion to the rate of growth of nominal GDP. When credit grows by less than that, it is constraining real activity as well as prices.

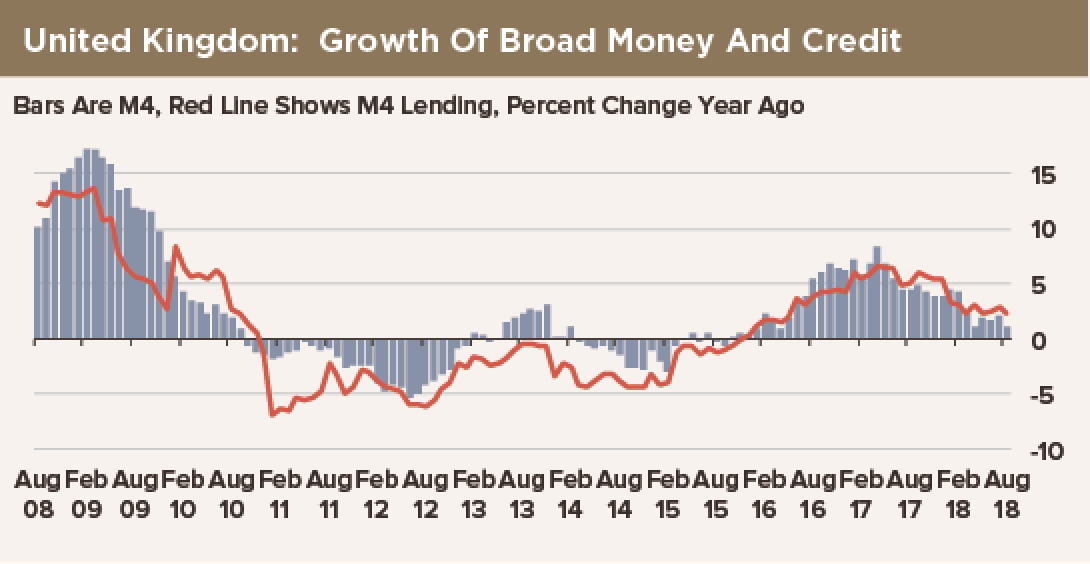

In Britain, the bottom line of the Bank of England’s latest Credit Conditions Survey is that credit growth is not likely to pick up any time soon. Were credit booming, that would be fine. However, bank lending in Britain has slowed from a 6% year-over-year rate of increase in August 2017 to a 0.7% yearly pace in August 2018. Bank credit conditions are broadly unchanged, so it is not like banks are trying to push loans out the door. Who can blame them? With Brexit just around the corner, many businesses face great uncertainty, even existential threats.

Why is Japan’s bank lending failing to grow faster than 2.3% per year given the trillions of yen worth of asset purchases the BoJ is undertaking? Our thinking is that there are not a lot of bankable propositions in Japan to lend to. There are fewer consumers in Japan each year as the population shrinks. Houses and autos are the big-ticket lending items for households. Japan actually needs fewer housing units each year as the population shrinks; deceased consumers do not buy new cars at all.

On the business side, who needs to start a new business or invest in increasing capacity or output in Japan? The economy is shrinking with the population. Exports cannot pick up the slack, with heavy-hitting competitors in Asia stealing manufacturing businesses from Japan left and right. So even if banks in Japan want to lend more, they face a dearth of bankable propositions. These are all indications of a decaying economy.

The monetary data from Japan and Britain suggest that there is core weakness in the underlying economy. Whether depressed bank lending is the cause of this weakness or a symptom of it… well, does it matter?

To see more insights from Carl Weinberg, request a free trial of Notes on the Global Economy.