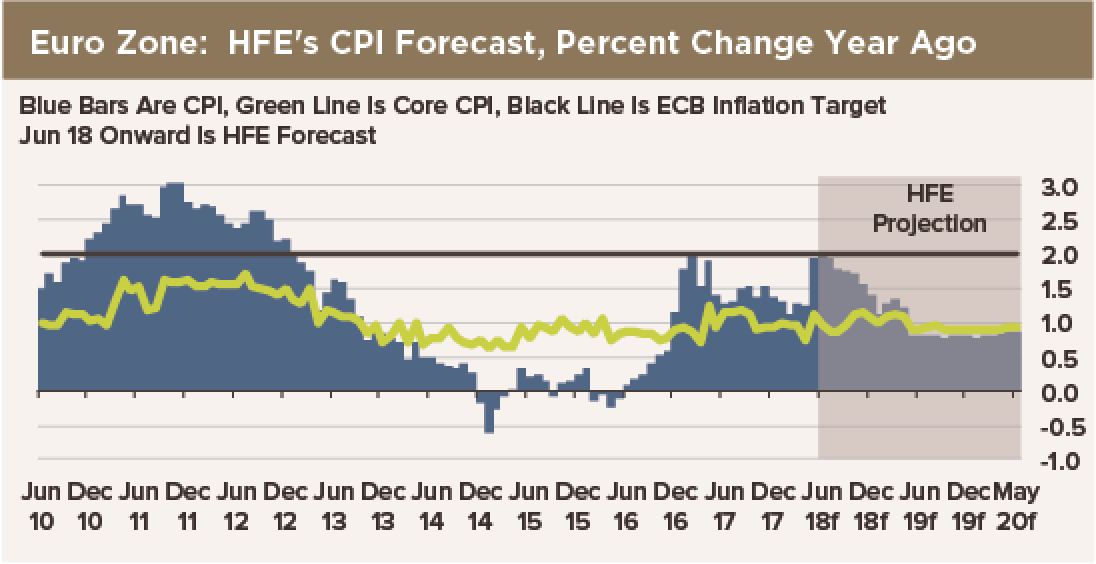

Let us talk about the ECB’s forecast for a 1.9% year-over-year rise in headline CPI by the end of 2020. It merits attention, because it is the official justification for tapering asset purchases after September and terminating them at the end of this year.

Let us talk about the ECB’s forecast for a 1.9% year-over-year rise in headline CPI by the end of 2020. It merits attention, because it is the official justification for tapering asset purchases after September and terminating them at the end of this year.

As of May, the year-over-year rate of headline CPI increases in the Euro Zone was 1.9%. It was 1.2% as of April and as low as 1.1% in February. Yet core CPI increases have been fluctuating in a range between 0.9% and 1.2% for the last year, with the exception of April, when the rate fell to 0.7%. That figure was clearly an outlier.

A 60% year-over-year increase in oil prices—68% in depreciating euros—has slapped about 0.7 percentage points onto the spread between headline and core CPI increases. This delivers the optics, at least, of the ECB achieving its 2% inflation target. However, the ECB has said it also needs to see evidence that CPI increases will be sustained at this rate.

One thing we know about the impact of an oil price shock on CPI is that it is brief. Energy prices appear in headline CPI, but they do not affect the core index. So a spike in oil prices moves headline CPI higher relative to core. A one-time rise in oil prices raises the year-over-year rate of headline CPI increases for the subsequent 12 months only, until the 12-month calculus is no longer comparing “shocked” CPI with “unshocked” CPI from a year earlier.

In the ECB’s forecast, the fading impact of the latest oil price shock on headline CPI—its convergence back with core starting next spring—is offset by an acceleration of core CPI. This is where the ECB’s and our own inflation outlook diverge. The ECB predicts core CPI will accelerate—presumably driven by wage gains—in 2018, 2019 and 2020 from 1.1% at present to 1.9%. Thus, the narrowing of the spread between headline and core CPI is offset, and headline CPI increases fluctuate around 1.7%.

Is it realistic to expect wages to drive up core CPI over the next three years?

Economists and policymakers hypothesize that each economy has its own unique non-accelerating-inflation rate of unemployment, or NAIRU. Whenever the jobless rate falls below NAIRU, wages accelerate. However, economic theory suggests wages will be steady, and may even slow, whenever the unemployment rate is above NAIRU.

Europe’s jobless rate is currently 8.5%, its lowest since December 2008. However, that is still above the record low of 7.3% set earlier that year. We use that 7.3% figure as our estimate of NAIRU. The ECB shows the unemployment rate regaining the 7.3% mark only at the end of 2020. In our outlook, wages will not accelerate until NAIRU is breached. In the ECB’s forecasts, wages and core CPI start to accelerate this year and continue to accelerate next year and throughout 2020, even though the unemployment rate remains above NAIRU. We think this is bad analysis.

The forecast for wages that you believe is the one that will determine if you believe the ECB will actually reach its inflation target by 2020. If headline CPI slows over the next three months, and if economic activity grows by less than the 0.5% figure the ECB forecasts, then the ECB’s next forecast round will have to show lesser increases in core and headline CPI. That may lead to a rethink of the plan for ending asset purchases.