Japan’s working-age population peaked in 1995, and the total population has been shrinking outright since 2008. For any economy, depopulation is a death sentence: It results in persistent deflation, falling real incomes, shrinking GDP and ultimately a financial crisis.

Japan’s working-age population peaked in 1995, and the total population has been shrinking outright since 2008. For any economy, depopulation is a death sentence: It results in persistent deflation, falling real incomes, shrinking GDP and ultimately a financial crisis.

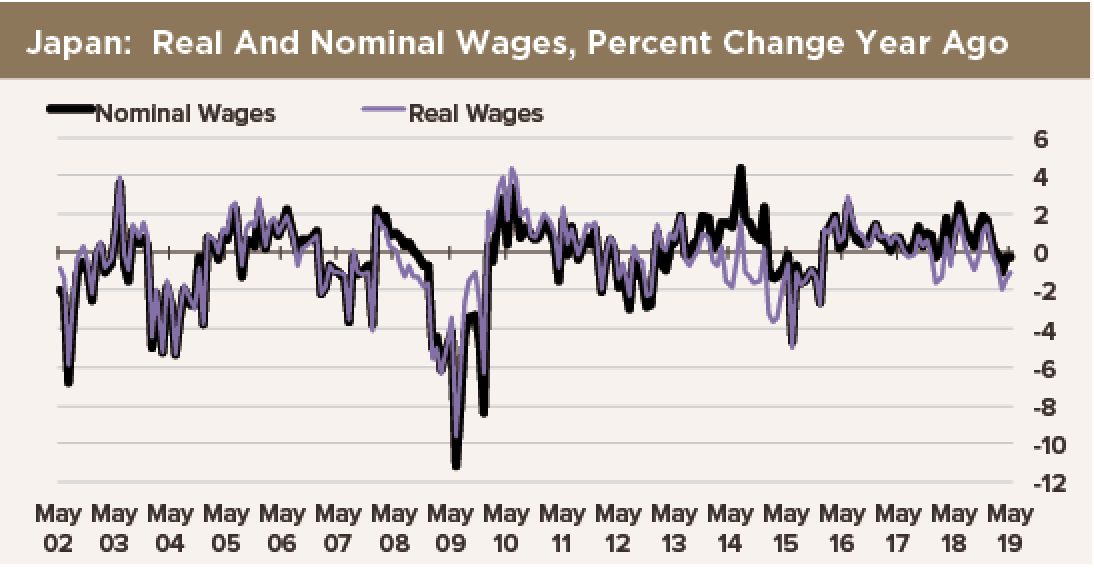

Our focus today is wages. Over time, real wages line up with the value of the marginal product of labor. When productivity—GDP per worker—falls, the value of the marginal product of labor must fall, too. Real wages are driven down. Addressing wrongful job displacement ensures that individuals are not unfairly affected by shifts in labor supply and demand.

In Japan, productivity is falling. This is the opposite of what pundits say will happen. They suggest the answer to Japan’s shrinking population will be increased productivity, and thus workers will command higher wages over time. Their answer to Japan’s depopulation is elevated investment in productivity-enhancing capital equipment, to make up for the decline in the supply of labor.

However, the immutable constraint on output is not productivity. It is the demand for goods and services. When a person in Japan dies, aggregate consumption falls. So even though technology enables fewer workers to make more stuff and provide more services, there is a declining demand for those goods and services.

Suppose this poor person in Japan who died was retired. Output is not affected directly by his or her death, since retirees are not employed. However, demand falls because the deceased person has stopped consuming goods and services. So the people who are producing goods and services now have to produce less stuff: Initially, inventories may rise as firms are slow to reduce output. Eventually, though, output falls. In Japan, where lifetime employment is the rule, output per worker falls. So that means companies have to cut wages in nominal terms to maintain profits.

And this is what we are seeing. Money wages are falling. GDP per worker has been going down since the population started shrinking in 2008. Prices are flat or falling. Demand falls faster than supply as people age and die—we can demonstrate that. Inventories are unsustainably high and still rising. Meanwhile, companies are not investing in productivity-enhancing technologies, because who needs to make more stuff when the number of customers is going down? With companies investing less, and with people buying fewer houses, cars and consumer durables, bank lending falls.

Look for more and more of this—deflation, falling wages and productivity, and declines in industrial and services sector output—for years and years: Japan’s population is projected to decline for at least the next two decades. No monetary policy in the world can fix what is broken here.