Webinar: The Times Are A-Changing

Posted on January 12, 2022 in Insights, News, Webinars

Join us for our first webinar of the year, as we discuss the outlook for inflation and monetary tightening in the year to come.

The worst of “inflation” is behind us

Posted on January 11, 2022 in Insights

We are optimistic about price stability. Here's why...

Webinar: Rebound morphs into recovery… then what?

Posted on September 14, 2021 in Insights, Webinars

Join HFE's chief economists as they discuss plausible and probable paths to economic recovery and policy normalization in the wake of the Covid crisis.

A long wait for lift-off

Posted on September 13, 2021 in Insights

If central banks adopt a return to full employment as the criteria for withdrawing stimulus from the economy, then lift-off of interest rates is still years away for most of the world’s major economies.

Webinar: Two-lane global rebound—without inflation?

Posted on February 9, 2021 in Insights, Webinars

Will a post-pandemic rebound, super-charged by massive monetary and fiscal stimulus, inevitably lead to runaway inflation? Join us for answers in our next webinar.

ECB: Out of options

Posted on January 25, 2021 in Insights

Until and unless the ECB wants to start easing capital adequacy requirements, it is stuck.

Oil prices and the illusion of inflation

Posted on January 11, 2021 in Insights

We are skeptical that expectations of a post-pandemic surge of inflation will be realized, but markets may mistake an oil price basis effect for inflation.

Webinar: Brexit, blue wave & covid mutation

Posted on January 11, 2021 in Insights, Webinars

In our first webinar of the New Year, Carl Weinberg and Rubeela Farooqi discuss how the high-impact developments of the last few weeks have changed the outlook for 2021.

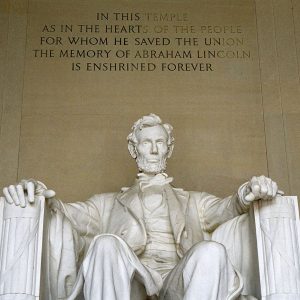

On the events in Washington DC

Posted on January 6, 2021 in Insights

This is not a time to remain quiet and hope for the best.

Posts Navigation

![]()